Sameer Dhanrajani in Top 10 of 100 Digital Influencers of 2020

Add Your Heading Text Here

YourStory’s 100 Digital Influencers of 2020 features thought leaders, who, through their writings, inspired hope and strength in a pandemic-hit year, and who, we believe, will influence and inspire the next generation of changemakers in 2021 and beyond.

Sameer Dhanrajani is featured in top 10 of 100 Digital Influencers of 2020.

Decoding AI and analytics for businesses is Sameer Dhanrajani’s daily duty. The former CSO of Fractal Analytics launched AIQRATE in 2019 and provides strategic AI business knowledge.

Sameer Dhanrajani has been known in the ecosystem for his knowledge and passion for understanding artificial intelligence and analytics. The AI advisor and former Fractal Anaytics CSO launched his startup AIQRATE in 2019 to provide strategic AI advisory services and consulting across multiple business segments to help businesses with their AI powered transformation and innovation journey. Sameer’s take on AI can be best understood through his book titled “AI and Analytics: Accelerating Business Decisions” and his TEDx talks. So if you are a business owner looking to understand AI, you know who to go to.

Read more at: https://yourstory.com/awards/yourstorys-100-digital-influencers-of-2020

Related Posts

AIQRATIONS

Personal Data Sharing & Protection: Strategic relevance from India’s context

Add Your Heading Text Here

India’s Investments in the digital financial infrastructure—known as “India Stack”—have sped up the large-scale digitization of people’s financial lives. As more and more people begin to conduct transactions online, questions have emerged about how to provide millions of customers adequate data protection and privacy while allowing their data to flow throughout the financial system. Data-sharing among financial services providers (FSPs) can enable providers to more efficiently offer a wider range of financial products better tailored to the needs of customers, including low-income customers.

However, it is important to ensure customers understand and consent to how their data are being used. India’s solution to this challenge is account aggregators (AAs). The Reserve Bank of India (RBI) created AAs in 2018 to simplify the consent process for customers. In most open banking regimes, financial information providers (FIPs) and financial information users (FIUs) directly exchange data. This direct model of data exchange—such as between a bank and a credit bureau—offers customers limited control and visibility into what data are being shared and to what end. AAs have been designed to sit between FIPs and FIUs to facilitate data exchange more transparently. Despite their name, AAs are barred from seeing, storing, analyzing, or using customer data. As trusted, impartial intermediaries, they simply manage consent and serve as the pipes through which data flow among FSPs. When a customer gives consent to a provider via the AA, the AA fetches the relevant information from the customer’s financial accounts and sends it via secure channels to the requesting institution. implementation of its policies for consensual data-sharing, including the establishment and operation of AAs. It provides a set of guiding design principles, outlines the technical format of data requests, and specifies the parameters governing the terms of use of requested data. It also specifies how to log consent and data flows.

There are several operational and coordination challenges across these three types of entities: FIPs, FIUs, and AAs. There are also questions around the data-sharing business model of AAs. Since AAs are additional players, they generate costs that must be offset by efficiency gains in the system to mitigate overall cost increases to customers. It remains an open question whether AAs will advance financial inclusion, how they will navigate issues around digital literacy and smartphone access, how the limits of a consent-based model of data protection and privacy play out, what capacity issues will be encountered among regulators and providers, and whether a competitive market of AAs will emerge given that regulations and interoperability arrangements largely define the business.

Account Aggregators (AA’s):

ACCOUNT AGGREGATORS (AAs) is one of the new categories of non banking financial companies (NBFCs) to figure into India Stack—India’s interconnected set of public and nonprofit infrastructure that supports financial services. India Stack has scaled considerably since its creation in 2009, marked by rapid digitization and parallel growth in mobile networks, reliable data connectivity, falling data costs, and continuously increasing smartphone use. Consequently, the creation, storage, use, and analyses of personal data have become increasingly relevant. Following an “open banking “approach, the Reserve Bank of India (RBI) licensed seven AAs in 2018 to address emerging questions around how data can be most effectively leveraged to benefit individuals while ensuring appropriate data protection and privacy, with consent being a key element in this. RBI created AAs to address the challenges posed by the proliferation of data by enabling data-sharing among financial institutions with customer consent. The intent is to provide a method through which customers can consent (or not) to a financial services provider accessing their personal data held by other entities. Providers are interested in these data, in part, because information shared by customers, such as bank statements, will allow providers to better understand customer risk profiles. The hypothesis is that consent-based data-sharing will help poorer customers qualify for a wider range of financial products—and receive financial products better tailored to their needs.

Data Sharing Model : The new perspective:

Paper based data collection is inconvenient , time consuming and costly for customers and providers. Where models for digital-sharing exist, they typically involve transferring data through intermediaries that are not always secure or through specialized agencies that offer little protection for customers. India’s consent-based data-sharing model provides a digital framework that enables individuals to give and withdraw consent on how and how much of their personal data are shared via secure and standardized channels. India’s guiding principles for sharing data with user consent—not only in the financial sector— are outlined in the National Data Sharing and Accessibility Policy (2012) and the Policy for Open Application Programming Interfaces for the Government of India. The Information Technology Act (2000) requires any entity that shares sensitive personal data to obtain consent from the user before the information is shared. The forthcoming Personal Data Protection Bill makes it illegal for institutions to share personal data without consent.

India’s Ministry of Electronics and Information Technology (MeitY) has issued an Electronic Consent Framework to define a comprehensive mechanism to implement policies for consensual data-sharing. It provides a set of guiding design principles, outlines the technical format of the data request, and specifies the parameters governing the terms of use of the data requested. It also specifies how to log both consent and data flows. This “consent artifact” was adopted by RBI, SEBI, IRDAI, and PFRDA. Components of the consent artifact structure include :

- Identifier : Specifies entities involved in the transaction: who is requesting the data, who is granting permission, who is providing the data, and who is recording consent.

- Data : Describes the type of data being accessed and the permissions for use of the data. Three types of permissions are available: view (read only), store, and query (request for specific data). The artifact structure also specifies the data that are being shared, date range for which they are being requested, duration of storage by the consumer, and frequency of access.

- Purpose : Describes end use, for example, to compute a loan offer.

- Log : Contains logs of who asked for consent, whether it was granted or not, and data flows.

- Digital signature : Identifies the digital signature and digital ID user certificate used by the provider to verify the digital signature. This allows providers to share information in encrypted form

The Approach :

THE AA consent based data sharing model mediates the flow of data between producers and users of data, ensuring that sharing data is subject to granular customer consent. AAs manage only the consent and data flow for the benefit of the consumer, mitigating the risk of an FIU pressuring consumers to consent to access to their data in exchange for a product or service. However, AAs, as entities that sit in the middle of this ecosystem, come with additional costs that will affect the viability of the business model and the cost of servicing consumers. FIUs most likely will urge consumers to go directly to an AA to receive fast, efficient, and low-cost services. However, AAs ultimately must market their services directly to the consumer. While AA services are not an easy sell, the rising levels of awareness among Indian consumers that their data are being sold without their consent or knowledge may give rise to the initial wave of adopters. While the AA model is promising, it remains to be seen how and when it will have a direct impact on the financial lives of consumers.

Differences between Personal Data Protection & GDPR ?

There are some major differences between the two.

First, the bill gives India’s central government the power to exempt any government agency from the bill’s requirements. This exemption can be given on grounds related to national security, national sovereignty, and public order.

While the GDPR offers EU member states similar escape clauses, they are tightly regulated by other EU directives. Without these safeguards, India’s bill potentially gives India’s central government the power to access individual data over and above existing Indian laws such as the Information Technology Act of 2000, which dealt with cyber crime and e-commerce.

Second, unlike the GDPR, India’s bill allows the government to order firms to share any of the non personal data they collect with the government. The bill says this is to improve the delivery of government services. But it does not explain how this data will be used, whether it will be shared with other private businesses, or whether any compensation will be paid for the use of this data.

Third, the GDPR does not require businesses to keep EU data within the EU. They can transfer it overseas, so long as they meet conditions such as standard contractual clauses on data protection, codes of conduct, or certification systems that are approved before the transfer.

The Indian bill allows the transfer of some personal data, but sensitive personal data can only be transferred outside India if it meets requirements that are similar to those of the GDPR. What’s more, this data can only be sent outside India to be processed; it cannot be stored outside India. This will create technical issues in delineating between categories of data that have to meet this requirement, and add to businesses’ compliance costs.

Related Posts

AIQRATIONS

AI Strategy: The Epiphany of Digital Transformation

Add Your Heading Text Here

In the past months due to lockdowns and WFH, enterprises have got an epiphany of massive shifts of business and strategic models for staying relevant and solvent. Digital transformation touted as the biggest strategic differentiation and competitive advantages for enterprises faced a quintessential inertia of mass adoption in the legacy based enterprises and remained more on business planning slides than in full implementation. However, Digital Transformation is not about aggregation of exponential technologies and adhoc use cases or stitching alliances with deep tech startups. The underpinning of Digital transformation is AI and how AI strategy has become the foundational aspect of accomplishing digital transformation for enterprises and generating tangible business metrics. But before we get to the significance of AI strategy in digital transformation, we need to understand the core of digital transformation itself. Because digital transformation will look different for every enterprise, it can be hard to pinpoint a definition that applies to all. However, in general terms: we define digital transformation as the integration of core areas of business resulting in fundamental changes to how businesses operate and how they deliver value to customers.

Though, in specific terms digital transformation can take a very interesting shape according to the business moment in question. From a customer’s point of view, “Digital transformation closes the gap between what digital customers already expect and what analog businesses actually deliver.”

Does Digital Transformation really mean bunching exponential technologies? I believe that digital transformation is first and foremost a business transformation. Digital mindset is not only about new age technology, but about curiosity, creativity, problem-solving, empathy, flexibility, decision-making and judgment, among others. Enterprises needs to foster this digital mindset, both within its own boundaries and across the company units. The World Economic Forum lists the top 10 skills needed for the fourth industrial revolution. None of them is totally technical. They are, rather, a combination of important soft skills relevant for the digital revolution. You don’t need to be a technical expert to understand how technology will impact your work. You need to know the foundational aspects, remain open-minded and work with technology mavens. Digital Transformation is more about cultural change that requires enterprises to continually challenge the status quo, experiment often, and get comfortable with failure. The most likely reason for business to undergo digital transformation is the survival & relevance issue. Businesses mostly don’t transform by choice because it is expensive and risky. Businesses go through transformation when they have failed to evolve. Hence its implementation calls for tough decisions like walking away from long-standing business processes that companies were built upon in favor of relatively new practices that are still being defined.

Business Implementation aspects of Digital Transformation

Disruption in digital business implies a more positive and evolving atmosphere, instead of the usual negative undertones that are attached to the word. According to the MIT Center for Digital Business, “Companies that have embraced digital transformation are 26 percent more profitable than their average industry competitors and enjoy a 12 percent higher market valuation.” A lot of startups and enterprises are adopting an evolutionary approach in transforming their business models itself, as part of the digital transformation. According to Mckinsey, One-third of the top 20 firms in industry segments will be disrupted by new competitors within five years.

The various Business Models being adopted in Digital Transformation era are:

- The Subscription Model (Netflix, Dollar Shave Club, Apple Music) Disrupts through “lock-in” by taking a product or service that is traditionally purchased on an ad hoc basis, and locking-in repeat custom by charging a subscription fee for continued access to the product/service

- The Freemium Model (Spotify, LinkedIn, Dropbox) Disrupts through digital sampling, where users pay for a basic service or product with their data or ‘eyeballs’, rather than money, and then charging to upgrade to the full offer. Works where marginal cost for extra units and distribution are lower than advertising revenue or the sale of personal data

- The Free Model (Google, Facebook) Disrupts with an ‘if-you’re-not-paying-for-the-product-you-are-the-product’ model that involves selling personal data or ‘advertising eyeballs’ harvested by offering consumers a ‘free’ product or service that captures their data/attention

- The Marketplace Model (eBay, iTunes, App Store, Uber, Airbnb) Disrupts with the provision of a digital marketplace that brings together buyers and sellers directly, in return for a transaction or placement fee or commission

- The Access-over-Ownership Model (Zipcar, Peer buy) Disrupts by providing temporary access to goods and services traditionally only available through purchase. Includes ‘Sharing Economy’ disruptors, which takes a commission from people monetizing their assets (home, car, capital) by lending them to ‘borrowers’

- The Hypermarket Model (Amazon, Apple) Disrupts by ‘brand bombing’ using sheer market power and scale to crush competition, often by selling below cost price

- The Experience Model (Tesla, Apple) Disrupts by providing a superior experience, for which people are prepared to pay

- The Pyramid Model (Amazon, Microsoft, Dropbox) Disrupts by recruiting an army of resellers and affiliates who are often paid on a commission-only mode

- The On-Demand Model (Uber, Operator, TaskRabbit) Disrupts by monetizing time and selling instant-access at a premium. Includes taking a commission from people with money but no time who pay for goods and services delivered or fulfilled by people with time but no money

- The Ecosystem Model (Apple, Google) Disrupts by selling an interlocking and interdependent suite of products and services that increase in value as more are purchased. Creates consumer dependency

Since Digital Transformation and its manifestation into various business models are being fast adopted by startups, there are providing tough competition to incumbent corporate houses and large enterprises. Though enterprises are also looking forward to digitally transform their enterprise business, the scale and complexity makes it difficult and resource consuming activity. It has imperatively invoked the enterprises to bring certain strategy to counter the cannibalizing effect in the following ways:

- The Block Strategy. Using all means available to inhibit the disruptor. These means can include claiming patent or copyright infringement, erecting regulatory hurdles, and using other legal barriers.

- The Milk Strategy. Extracting the most value possible from vulnerable businesses while preparing for the inevitable disruption

- The Invest in Disruption Model. Actively investing in the disruptive threat, including disruptive technologies, human capabilities, digitized processes, or perhaps acquiring companies with these attributes

- The Disrupt the Current Business Strategy. Launching a new product or service that competes directly with the disruptor, and leveraging inherent strengths such as size, market knowledge, brand, access to capital, and relationships to build the new business

- The Retreat into a Strategic Niche Strategy. Focusing on a profitable niche segment of the core market where disruption is less likely to occur (e.g. travel agents focusing on corporate travel, and complex itineraries, book sellers and publishers focusing on academia niche)

- The Redefine the Core Strategy. Building an entirely new business model, often in an adjacent industry where it is possible to leverage existing knowledge and capabilities (e.g. IBM to consulting, Fujifilm to cosmetics)

- The Exit Strategy. Exiting the business entirely and returning capital to investors, ideally through a sale of the business while value still exists (e.g. MySpace selling itself to Newscorp)

The curious evolution of AI and its relevance in digital transformation

So here’s an interesting question, AI has been around for more than 60 years, then why is it that it is only gaining traction with the advent of digital? The first practical application of such “machine intelligence” was introduced by Alan Turing, British mathematician and WWII code-breaker, in 1950. He even created the Turing test, which is still used today, as a benchmark to determine a machine’s ability to “think” like a human.The biggest differences between AI then and now are Hardware limitations, access to data, and rise of machine learning.

Hardware limitations led to the non-sustenance of AI adoption till late 1990s. There were many instances where the scope and opportunity of AI led transformation was identified and appreciated by implementation saw more difficult circumstances. The field of AI research was founded at a workshop held on the campus of Dartmouth College during the summer of 1956. But Eventually it became obvious that they had grossly underestimated the difficulty of the project due to computer hardware limitations. The U.S. and British Governments stopped funding undirected research into artificial intelligence, leading to years known as an “AI winter”.

In another example, again in 1980, a visionary initiative by the Japanese Government inspired governments and industry to provide AI with billions of dollars, but by the late 80s the investors became disillusioned by the absence of the needed computer power (hardware) and withdrew funding again. Investment and interest in AI boomed in the first decades of the 21st century, when machine learning was successfully applied to many problems in academia and industry due to the presence of powerful computer hardware. Teaming this with the rise in digital, leading to an explosion of data and adoption of data generation in every aspect of business, made it highly convenient for AI to not only be adopted but to evolve to more accurate execution.

The Core of Digital Transformation: AI Strategy

According to McKinsey, by 2023, 85 percent of all digital transformation initiatives will be embedded with AI strategy at its core. Due to radical computational power, near-endless amounts of data, and unprecedented advances in ML algorithms, AI strategy will emerge as the most disruptive business scenario, and its manifestation into various trends that we see and will continue to see, shall drive the digital transformation as we understand it. The following will the future forward scenarios of AI strategy becoming core to digital transformation:

AI’s growing entrenchment: This time, the scale and scope of the surge in attention to AI is much larger than before. For starters, the infrastructure speed, availability, and sheer scale has enabled bolder algorithms to tackle more ambitious problems. Not only is the hardware faster, sometimes augmented by specialized arrays of processors (e.g., GPUs), it is also available in the shape of cloud services , data farms and centers

Geography, societal Impact: AI adoption is reaching institutions outside of the industry. Lawyers will start to grapple with how laws should deal with autonomous vehicles; economists will study AI-driven technological unemployment; sociologists will study the impact of AI-human relationships. This is the world of the future and the new next.

Artificial intelligence will be democratized: As per the results of a recent Forrester study , it was revealed that 58 percent of professionals researching artificial intelligence ,only 12 percent are actually using an AI system. Since AI requires specialized skills or infrastructure to implement, Companies like Facebook have realized this and are already doing all they can to simplify the implementation of AI and make it more accessible. Cloud platforms like Google APIs, Microsoft Azure, AWS are allowing developers to create intelligent apps without having to set up or maintain any other infrastructure.

Niche AI will Grow: By all accounts, 2020 & beyond won’t be for large, general-purpose AI systems. Instead, there will be an explosion of specific, highly niche artificial intelligence adoption cases. These include autonomous vehicles (cars and drones), robotics, bots (consumer-orientated such as Amazon Echo , and industry specific AI (think finance, health, security etc.).

Continued Discourse on AI ethics, security & privacy: Most AI systems are immensely complex sponges that absorb data and process it at tremendous rates. The risks related to AI ethics, security and privacy are real and need to be addressed through consideration and consensus. Sure, it’s unlikely that these problems will be solved in 2020, but as long as the conversation around these topics continues, we can expect at least some headway.

Algorithm Economy: With massive data generation using flywheels, there will be an economy created for algorithms, like a marketplace for algorithms. The engineers, data scientists, organizations, etc. will be sharing algorithms for using the data to extract required information set.

Where is AI Heading in the Digital Road?While much of this is still rudimentary at the moment, we can expect sophisticated AI to significantly impact our everyday lives. Here are four ways AI might affect us in the future:

Humanizing AI: AI will grow beyond a “tool” to fill the role of “co-worker.” Most AI software is too hidden technologically to significantly change the daily experience for the average worker. They exist only in a back end with little interface with humans. But several AI companies combine advanced AI with automation and intelligent interfaces that drastically alter the day to day workflow for workers

Design Thinking & behavioral science in AI: We will witness Divergence from More Powerful Intelligence To More Creative Intelligence. There have already been attempts to make AI engage in creative efforts, such as artwork and music composition. we’ll see more and more artificial intelligence designing artificial intelligence, resulting in many mistakes, plenty of dead ends, and some astonishing successes.

Rise of Cyborgs: As augmented AI is already the mainstream thinking; the future might hold witness to perfect culmination of man-machine augmentation. AI augmented to humans, intelligently handling operations which human cannot do, using neural commands.

AI Oracle : AI might become so connected with every aspect of our lives, processing though every quanta of data from every perspective that it would perfectly know how to raise the overall standard of living for the human race. People would religiously follow its instructions (like we already follow GPS navigations) leading to leading to an equation of dependence closer to devotion.

The Final Word

Digital business transformation is the ultimate challenge in change management. It impacts not only industry structures and strategic positioning, but it affects all levels of an organization (every task, activity, process) and even its extended supply chain. Hence to brace Digital led disruption, one has to embrace AI-led strategy. Organizations that deploy AI strategically will ultimately enjoy advantages ranging from cost reductions and higher productivity to top-line benefits such as increasing revenue and profits, richer customer experiences, and working-capital optimization.

( AIQRATE, A bespoke global AI advisory and consulting firm. A first in its genre, AIQRATE provides strategic AI advisory services and consulting offerings across multiple business segments to enable clients navigate their AI powered transformation, innovation & revival journey and accentuate their decision making and business performance.

AIQRATE works closely with Boards, CXOs and Senior leaders advising them on their Analytics to AI journey construct with the art of possible AI roadmap blended with a jump start approach to AI driven transformation with AI@scale centric strategy; AIQRATE also consults on embedding AI as core to business strategy within business processes & functions and augmenting the overall decision-making capabilities. Our bespoke AI advisory services focus on curating & designing building blocks of AI strategy, embed AI@scale interventions and create AI powered organizations.

AIQRATE’s path breaking 50+ AI consulting frameworks, methodologies, primers, toolkits and playbooks crafted by seasoned and proven AI strategy advisors enable Indian & global enterprises, GCCs, Startups, SMBs, VC/PE firms, and Academic Institutions enhance business performance & ROI and accelerate decision making capability. AIQRATE also provide advisory support to Technology companies, business consulting firms, GCCs, AI pure play outfits on curating discerning AI capabilities, solutions along with differentiated GTM and market development strategies.

Visit www.aiqrate.ai to experience our AI advisory services & consulting offerings. Follow us on Linkedin | Facebook | YouTube | Twitter | Instagram )

Related Posts

AIQRATIONS

How Startups can leverage AI to gain competitive advantage

Add Your Heading Text Here

Despite nationwide venture funding hitting a multiyear low, venture capital deployed to artificial intelligence (AI) startups has reached a record high.

Last year, VCs struck 658 deals with AI companies, nearly five times the number that signed on the dotted line four years before. To date, the market contains 2,045 AI startups and more than 17,000 market followers, with more joining by the day.

AI’s rapid rise has swept up startups and enterprises alike, including U.S. automaker Ford, which recently bought AI startup Argo for $1 billion. The acquisition cements experts’ suspicions of Ford’s coming foray into self-driving technology. Other startups — so many, in fact, that entrepreneurs need a “best of” guide — are betting heavily on bot platforms.

So while we’ve just glimpsed the tip of this innovation iceberg, it’s clear AI is no longer some nebulous technology of the future. Sixty-eight percent of marketing executives, report using AI in their operations. For a technology that only went mainstream in 2016 and barely existed four years ago, that’s a remarkable adoption rate. How, regardless of the platform you choose, can you join forward-thinking entrepreneurs and build your business with AI? Over the last few years , I have worked closely with multiple start ups across genres and ,So far, four ways stand out:

1. Get to know your next customer.

A politician wouldn’t dream of delivering a small-town stump speech to her urban constituents. Why? Because you’ve got to know your audience. The same is true for entrepreneurs. Before you broadcast your message, you need to know who you’re trying to reach.

Node, an account-based intelligence startup, uses natural language processing — a fancy term for teaching a computer to understand how we humans speak and write — to develop customer profiles. Node is crunching vast swaths of data to connect the dots between marketers and the companies they’re trying to reach.

Once you have ample customer data — Node uses data crawlers to scrape information from social media, news sites and more — pair machine learning and natural language processing models to extract sentiments from unstructured data. Then, just as senators segment constituents into demographic groups, Node uses cluster analysis to sort clients’ customers into like cohorts.

2. See how people truly use your product.

If, heaven forbid, you forgot to tag your neighbor at last week’s house party, Facebook was no doubt there to remind you of your error. How does Facebook know which of your friends you left untagged? It has gone all-in on an AI technique called convolutional neural networks.

Convolutional neural networks, which loosely model how the brain’s visual cortex interacts with the eyes, work by separating an image into tiny portions before running each of those specks through a multilayered filter. It then “sees” where each speck overlaps with other parts of the image, and through automated iterations, it puts together a full image.

Many different ways exist to apply this technology, but retail businesses can start with image classification. Try using a convolutional neural network to break down photos of your products posted online. The model can identify customer segments that frequently use your product, where they’re using it and whether they commonly pair other products with yours. Essentially, this automated image analysis can show you how your products fit into customers’ lives, allowing you to tailor your marketing materials to fit.

3. Get inside the user’s head.

Success on social media requires careful listening and quick action. When a social campaign isn’t working, it’s best to put it out of its misery quickly. On the other hand, when one strikes a chord with customers, doubling down pays dividends.

But to do so, you need real-time insights about customers’ reactions to your content. Fortunately, AI can take the emotional temperature of thousands of customers at once. Dumbstruck, a video-testing and analytics startup that I advise, has added natural language processing to its emotional analytics stack. This allows it to provide moment-by-moment insights into viewers’ reactions to media. Dumbstruck’s model grows stronger with each reaction analyzed, producing a program that perceives human emotions even better than some people can.

4. Provide affordable, always-on support.

Customer service is — or should be, according to consumers — the department that never sleeps. More than half of people, 50.6 percent to be precise, believe a business should be available 24/7 to answer their every question and concern. When asked whether businesses should be available via a messaging app, the “yes” votes jump to nearly two in three.

Fortunately, bots don’t sleep, eat or go off-script. A well-built bot can offer cost-effective, constant customer service. Of course, grooming your bot to serve customers requires front-end data — ideally hundreds of thousands of example conversations — but you can get started with a human-chatbot hybrid. With this approach, the bot answers run-of-the-mill questions, while a human takes over for the more complex ones. Then, as the data builds and the model matures, you can phase in full automation.

AI’s Impact on small businesses and startups

Small enterprises will begin to use the tried and tested platforms in innovative ways. While startups will gain a competitive edge in capturing the AI market, the larger enterprises will provide the infrastructure to startups for building innovative services. It is somewhat similar to the business model followed when the cable technology was introduced.

Startups leveraging AI technology for industry verticals, like agriculture, manufacturing or insurance are bound to be successful.

Startups can empower established insurance companies like State Farm, Allstate and Farmers with technology enabling them to become more proactive in policy planning. For instance, a new AI insurance underwriter will help to forecast natural disasters and accidents, and adjust premiums.

The predictive decision-making capabilities are more than just a novel technology. You can manage food supply chains with the help of AI. Startups could develop end-to-end farming solutions with AI analytics for reducing food waste. It will have a huge impact in tackling global issues of hunger and famine.

Whether serving as a research assistant in a large corporation, acting as a voice-activated resource in difficult medical procedures, AI is fast becoming a reality. The AI revolution will benefit new players who learn quickly to use it to their advantage. AI will be a fundamental predictive enabler helping us solve large-scale problems, and startups are poised to gain a competitive edge.

So what’s the ground level AI sentiment of Startups? – Mix of Hope & Fear

Regardless of which industry you operate, be careful that AI will affect your world in some way. Look into what is present now and how you can utilize it to gain a competitive edge.

The possibilities with AI are endless; enterprises will become efficient, intelligent and cost-effective.

Undoubtedly, the digital revolution and AI will advance to a point where it will offer real-world benefits to every business- large and small.

Mark Zuckerberg says, “We’re working on AI because we think more intelligent services will be much more useful for you to use.”

AI is relevant because of its immense power to deliver useful solutions; its other building blocks including cloud computing and superfast connectivity. But, if you want to take advantage of this novel technology you will need a reliable, secure, and continuously evolving infrastructure.

Related Posts

AIQRATIONS

AI & FINTECH – TWO GAME CHANGING REVOLUTIONS IN THE DIGITAL ERA

Add Your Heading Text Here

More investors are setting their sights on the financial technology (Fintech) arena. According to consulting firm Accenture, investment in Fintech firms rose by 10 percent worldwide to the tune of $23.2 billion in 2016.

China is leading the charge after securing $10 billion in investments in 55 deals which account for 90 percent of investments in Asia-Pacific. The US came second taking in $6.2 billion in funding. Europe, also saw an 11 percent increase in deals despite Britain seeing a decrease in funding due to the uncertainty from the Brexit vote.

The excitement stems from the disruption of traditional financial institutions (FIs) such as banks, insurance, and credit companies by technology. The next unicorn might be among the hundreds of tech startups that are giving Fintech a go.

What exactly is going to be the next big thing has yet to be determined, but artificial intelligence (AI) will play a huge part.

Stiffening competition

The growing reality is that, while opportunities are abound, competition is also heating up.

Take, for example, the number of Fintech startups that aim to digitize routine financial tasks like payments. In the US, the digital wallet and payments segment is fiercely competitive. Pioneers like PayPal see themselves being taken on by other tech giants like Google and Apple, by niche-oriented ventures like Venmo, and even by traditional FIs.

Most recently, the California-based robo-advisor, Wealthfront, has added artificial intelligence capabilities to track account activity on its own product and other integrated services such as Venmo, to analyze and understand how account holders are spending, investing and making their financial decisions, in an effort to provide more customized advice to their customers. Sentient Technologies, which has offices in both California and Hong Kong, is using artificial intelligence to continually analyze data and improve investment strategies. The company has several other AI initiatives in addition to its own equity fund. AI is even being used for banking customer service. RBS has developed Luvo, a technology which assists it service agents in finding answers to customer queries. The AI technology can search through a database, but also has a human personality and is built to learn continually and improve over time.

Some ventures are seeing bluer oceans by focusing on local and regional markets where conditions are somewhat favorable.

The growth of China’s Fintech was largely made possible by the relative age of its current banking system. It was easier for people to use mobile and web-based financial services such as Alibaba’s Ant Financial and Tencent since phones were more pervasive and more convenient to access than traditional financial instruments.

In Europe, the new Payment Services Directive (PSD2) set to take effect in 2018 has busted the game wide open. Banks are obligated to open up their application program interfaces (APIs) enabling Fintech apps and services to tap into users’ bank accounts. The line between banks and fintech companies are set to blur so just about everyone in finance is set to compete with old and new players alike.

Leveraging Digital

Convenience has become a fundamental selling point to many users that a number of Fintech ventures have zeroed in on delivering better user experiences for an assortment of financial tasks such as payments, budgeting, banking, and even loan applications.

There is a mad scramble among companies to leverage cutting-edge technologies for competitive advantage. Even established tech companies like e-commerce giant Amazon had to give due attention to mobile as users shift their computing habits towards phones and tablets. Enterprises are also working on transitioning to cloud computing for infrastructure.

But where do more advanced technologies such as AI come in?

The drive to eliminate human fallibility has also made artificial intelligence (AI) driven to the forefront of research and development. Its applications range from sorting what gets shown on your social media newsfeed to self-driving cars. It’s also expected to have a major impact in Fintech due to potential of game changing insights that can be derived from the sheer volume of data that humanity is generating. Enterprising ventures are banking on it to expose the gap in the market that has become increasingly small due to competition.

All about algorithms

AI and finance are no strangers to each other. Traditional banking and finance have relied heavily on algorithms for automation and analysis. However, these were exclusive only to large and established institutions. Fintech is being aimed at empowering smaller organizations and consumers, and AI is expected to make its benefits accessible to a wider audience.

AI has a wide variety of consumer-level applications for smarter and more error-free user experiences. Personal finance applications are now using AI to balance people’s budgets based specifically to a user’s behavior. AI now also serves as robo-advisors to casual traders to guide them in managing their stock portfolios.

For enterprises, AI is expected to continue serving functions such as business intelligence and predictive analytics. Merchant services such as payments and fraud detection are also relying on AI to seek out patterns in customer behavior in order to weed out bad transactions.

People may soon have very little excuse of not having a handle of their money because of these services

Concerns Going Forward

While artificial intelligence holds the promise of efficiency, better decision-making, stronger compliance and potentially even more profits for investors, the technology is young. Banks need to find ways to lower costs and technology is the most obvious answer. A logical response by banks is to automate as much decision-making as possible, hence the number of banks enthusiastically embracing AI and automation. But the unknown risks inherent in aspects of AI have not been eliminated. According to a Euromoney Survey and report commissioned by Baker & McKenzie, out of 424 financial professionals, 76% believe that financial regulators are not up to speed on AI and 47% are not confident that their own organizations understand the risks of using AI. Additionally an increasing reliance on artificial intelligence technologies comes with a reduction in jobs. Many argue that the human intuition plays a valuable role in risk assessment and that the black box nature of AI makes it difficult to understand certain unexpected outcomes or decisions produced by the technology.

Towards the future

With the stiff competition in Fintech, ventures have to deliver a truly valuable products and services in order to stand out. The venture that provides the best user experience often wins but finding this X factor has become increasingly challenging.

The developments in AI may provide that something extra especially if it could promise to eliminate the guess work and human error out of finance. It’s for these reasons that AI might just hold the key to what further Fintech innovations can be made.

Related Posts

AIQRATIONS

ACCELERATED DECISION MAKING AMPLIFIED BY REAL TIME ANALYTICS – A PERSPECTIVE

Add Your Heading Text Here

Companies are using more real-time analytics, because of the pressure to increase the speed and accuracy of business processes — particularly for digital business and the Internet of Things (IoT). Although data and analytics leaders intuitively understand the value of fast analytical insights, many are unsure how to achieve them.

Every large company makes thousands of real-time decisions each minute. For example, when a potential customer calls the contact center or visits the company’s website to gather product information, the company has a few seconds to figure out the best-next-action offer to propose to maximize the chance of making a sale. Or, when a customer presents a credit card to buy something or submits a withdrawal transaction request to an automated teller machine, a bank has one second or less to determine if the customer is who they say they are and whether they are likely to pay the bill when it is due. Of course, not all real-time decisions are tied to customers. Companies also make real-time decisions about internal operations, such as dynamically rerouting delivery trucks when a traffic jam forms; calling in a mechanic to replace parts in a machine when it starts to fail; or adjusting their manufacturing schedules when incoming materials fail to arrive on time.

Many decisions will be made in real time, regardless of whether real-time analytics are available, because the world is event-driven and the company has to respond immediately as events unfold. Improved real-time responses that are informed by fact-based, real-time analytics are optional, but clearly desirable.

Real-time analytics can be confusing, because different people may be thinking of different concepts when they use the term “real time.” Moreover, it isn’t always simple to determine where real-time analytics are appropriate, because the “right time” for analytics in a given business situation depends on many considerations; real-time is not always appropriate, or even possible. Finally, data and analytics leaders and their staff typically know less about real-time analytics than about traditional business intelligence and analytics.

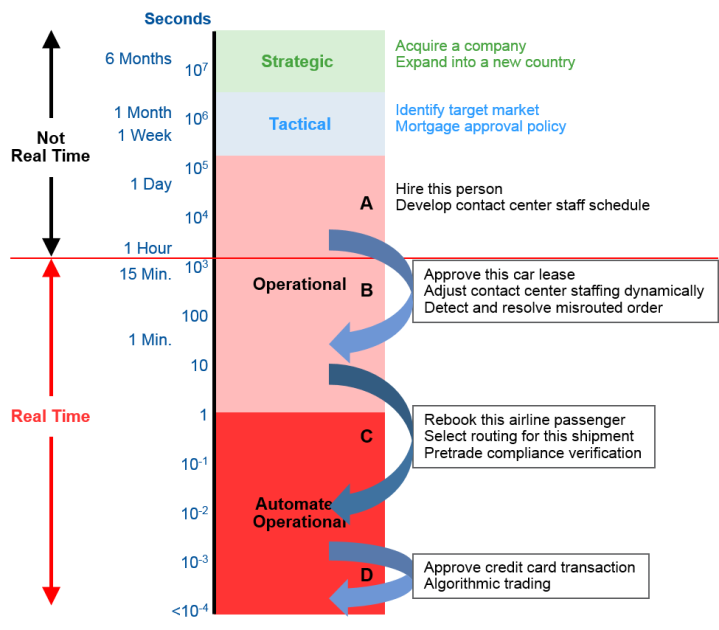

Find the certain concept of “Real Time” Relevant to Your Business Problem

Real-time analytics is defined as “the discipline that applies logic and mathematics to data to provide insights for making better decisions quickly.” Real time means different things to different people.

When engineers say “real time” they mean that a system will always complete the task within a specified time frame.

Each component and subtask within the system is carefully designed to provide predictable performance, avoiding anything that could take longer to occur than is usually the case. Real-time systems prevent random delays, such as Java garbage collection, and may run on real-time operating systems that avoid nondeterministic behavior in internal functions such as scheduling and dispatching. There is an implied service-level agreement or guarantee. Strictly speaking, a real-time system could take hours or more to do its work, but in practice, most real-time systems act in seconds, milliseconds or even microseconds.

The concept of engineering real time is most relevant when dealing with machines and fully automated applications that require a precise sequence and timing of interactions among multiple components. Control systems for airplanes, power plants, self-driving cars and other machines often use real-time design. Time-critical software applications, such as high-frequency trading (HFT), also leverage engineering real-time concepts although they may not be entirely real time.

Use Different Technology and Design Patterns for Real-Time Computation Versus Real-Time Solutions

Some people use the term real-time analytics to describe fast computation on historical data from yesterday or last year. It’s obviously better to get the answer to a query, or run a model, in a few seconds or minutes (business real time) rather than waiting for a multihour batch run. Real-time computation on small datasets is executed in-memory by Excel and other conventional tools. Real-time computation on large datasets is enabled by a variety of design patterns and technologies, such as:

- Preloading the data into an in-memory database or in-memory analytics tool with large amounts of memory

- Processing in parallel on multiple cores and chips

- Using faster chips or graphics processing units (GPUs)

- Applying efficient algorithms (for example, minimizing context switches)

- Leveraging innovative data architectures (for example, hashing and other kinds of encoding)

Most of these can be hidden within modern analytics products so that the user does not have to be aware of exactly how they are being used.

Real-time computation on historical data is not sufficient for end-to-end real-time solutions that enable immediate action on emerging situations. Analytics for real-time solutions requires two additional things:

- Data must be real time (current)

- Analytic logic must be predefined

If conditions are changing from minute to minute, a business needs to have situation awareness of what is happening right now. The decision must reflect the latest sensor readings, business transactions, web logs, external market data, social computing postings and other current information from people and things.

Real-time solutions use design patterns that enable them to access the input data quickly so that data movement does not become the weak link in the chain. There is no time to read large amounts of data one row or message at a time across a wide-area network. Analytics are run as close as possible to where the data is generated. For example, IoT applications run most real-time solutions on or near the edge, close to the devices. Also, HFT systems are co-located with the stock exchanges to minimize the distance that data has to travel. In some real-time solutions, including HFT systems, special high-speed networks are used to convey streaming data into the system.

Match the Speed of Analytics to the Speed of the Business Decision

Decisions have a range of natural timing, so “right time” is not always real time. Business analysts and solution architects should work with managers and other decision makers to determine how fast to make each decision. The two primary considerations are:

- How quickly will the value of the decision degrade?

- Decisions should be executed in real time if a customer is waiting on the phone for an answer; resources would be wasted if they sit idle; fraud would succeed; or physical processes would fail if the decision takes more than a few milliseconds or minutes. On the other hand, a decision on corporate strategy may be nearly as valuable in a month as it would be today, because its implementation will take place over months and years so starting a bit earlier may not matter much.

- How much better will a decision be if more time is spent?

- Simple, well-understood decisions on known topics, and for which data is readily available, can be made quickly without sacrificing much quality.

Lastly, Automate Decisions if Algorithms Can Represent the Entire Decision Logic

Algorithms offers the “last mile” of the decision. However, automating algorithms requires a well described process to code against. According to Gartner, “Decision automation is possible only when the algorithms associated with the applicable business policies can be fully defined.”

Final Word

Performing some analytics in real time is a goal in many analytics and business intelligence modernization programs. To operate in real time, data and analytics leaders must leverage predefined analytical models, rather than ad hoc models, and use current input data rather than just historical data.

Related Posts

AIQRATIONS

THE BEST PRACTICES FOR INTERNET OF THINGS ANALYTICS

Add Your Heading Text Here

In most ways, Internet of Things analytics are like any other analytics. However, the need to distribute some IoT analytics to edge sites, and to use some technologies not commonly employed elsewhere, requires business intelligence and analytics leaders to adopt new best practices and software.

There are certain prominent challenges that Analytics Vendors are facing in venturing into building a capability. IoT analytics use most of the same algorithms and tools as other kinds of advanced analytics. However, a few techniques occur much more often in IoT analytics, and many analytics professionals have limited or no expertise in these. Analytics leaders are struggling to understand where to start with Internet of Things (IoT) analytics. They are not even sure what technologies are needed.

Also, the advent of IoT also leads to collection of raw data in a massive scale. IoT analytics that run in the cloud or in corporate data centers are the most similar to other analytics practices. Where major differences appear is at the “edge” — in factories, connected vehicles, connected homes and other distributed sites. The staple inputs for IoT analytics are streams of sensor data from machines, medical devices, environmental sensors and other physical entities. Processing this data in an efficient and timely manner sometimes requires event stream processing platforms, time series database management systems and specialized analytical algorithms. It also requires attention to security, communication, data storage, application integration, governance and other considerations beyond analytics. Hence it is imperative to evolve into edge analytics and distribute the data processing load all across.

Hence, some IoT analytics applications have to be distributed to “edge” sites, which makes them harder to deploy, manage and maintain. Many analytics and Data Science practitioners lack expertise in the streaming analytics, time series data management and other technologies used in IoT analytics.

Some visions of the IoT describe a simplistic scenario in which devices and gateways at the edge send all sensor data to the cloud, where the analytic processing is executed, and there are further indirect connections to traditional back-end enterprise applications. However, this describes only some IoT scenarios. In many others, analytical applications in servers, gateways, smart routers and devices process the sensor data near where it is generated — in factories, power plants, oil platforms, airplanes, ships, homes and so on. In these cases, only subsets of conditioned sensor data, or intermediate results (such as complex events) calculated from sensor data, are uploaded to the cloud or corporate data centers for processing by centralized analytics and other applications.

The design and development of IoT analytics — the model building — should generally be done in the cloud or in corporate data centers. However, analytics leaders need to distribute runtime analytics that serve local needs to edge sites. For certain IoT analytical applications, they will need to acquire, and learn how to use, new software tools that provide features not previously required by their analytics programs. These scenarios consequently give us the following best practices to be kept in mind:

Develop Most Analytical Models in the Cloud or at a Centralized Corporate Site

When analytics are applied to operational decision making, as in most IoT applications, they are usually implemented in a two-stage process – In the first stage, data scientists study the business problem and evaluate historical data to build analytical models, prepare data discovery applications or specify report templates. The work is interactive and iterative.

A second stage occurs after models are deployed into operational parts of the business. New data from sensors, business applications or other sources is fed into the models on a recurring basis. If it is a reporting application, a new report is generated, perhaps every night or every week (or every hour, month or quarter). If it is a data discovery application, the new data is made available to decision makers, along with formatted displays and predefined key performance indicators and measures. If it is a predictive or prescriptive analytic application, new data is run through a scoring service or other model to generate information for decision making.

The first stage is almost always implemented centrally, because Model building typically requires data from multiple locations for training and testing purposes. It is easier, and usually less expensive, to consolidate and store all this data centrally. Also, It is less expensive to provision advanced analytics and BI platforms in the cloud or at one or two central corporate sites than to license them for multiple distributed locations.

The second stage — calculating information for operational decision making — may run either at the edge or centrally in the cloud or a corporate data center. Analytics are run centrally if they support strategic, tactical or operational activities that will be carried out at corporate headquarters, at another edge location, or at a business partner’s or customer’s site.

Distribute the Runtime Portion of Locally Focused IoT Analytics to Edge Sites

Some IoT analytics applications need to be distributed, so that processing can take place in devices, control systems, servers or smart routers at the sites where sensor data is generated. This makes sure the edge location stays in operation even when the corporate cloud service is down. Also, wide-area communication is generally too slow for analytics that support time-sensitive industrial control systems.

Thirdly, transmitting all sensor data to a corporate or cloud data center may be impractical or impossible if the volume of data is high or if reliable, high-bandwidth networks are unavailable. It is more practical to filter, condition and do analytic processing partly or entirely at the site where the data is generated.

Train Analytics Staff and Acquire Software Tools to Address Gaps in IoT-Related Analytics Capabilities

Most IoT analytical applications use the same advanced analytics platforms, data discovery tools as other kinds of business application. The principles and algorithms are largely similar. Graphical dashboards, tabular reports, data discovery, regression, neural networks, optimization algorithms and many other techniques found in marketing, finance, customer relationship management and advanced analytics applications also provide most aspects of IoT analytics.

However, a few aspects of analytics occur much more often in the IoT than elsewhere, and many analytics professionals have limited or no expertise in these. For example, some IoT applications use event stream processing platforms to process sensor data in near real time. Event streams are time series data, so they are stored most efficiently in databases (typically column stores) that are designed especially for this purpose, in contrast to the relational databases that dominate traditional analytics. Some IoT analytics are also used to support decision automation scenarios in which an IoT application generates control signals that trigger actuators in physical devices — a concept outside the realm of traditional analytics.

In many cases, companies will need to acquire new software tools to handle these requirements. Business analytics teams need to monitor and manage their edge analytics to ensure they are running properly and determine when analytic models should be tuned or replaced.

Increased Growth, if not Competitive Advantage

The huge volume and velocity of data in IoT will undoubtedly put new levels of strain on networks. The increasing number of real-time IoT apps will create performance and latency issues. It is important to reduce the end-to-end latency among machine-to-machine interactions to single-digit milliseconds. Following the best practices of implementing IoT analytics will ensure judo strategy of increased effeciency output at reduced economy. It may not be suffecient to define a competitive strategy, but as more and more players adopt IoT as a mainstream, the race would be to scale and grow as quickly as possible.

Related Posts

AIQRATIONS

Can AI and Eternal Humanity both Co-exist

Add Your Heading Text Here

At the turn of the century, it’s likely few, if any, could anticipate the many ways artificial intelligence would later affect our lives.

Take Emotional Robot with Intelligent Network, or ERWIN, for example. He’s designed to mimic human emotions like sadness and happiness in order to help researchers understand how empathy affects human-robot connections. When ERWIN works with Keepon—a robot who looks eerily similar to a real person—scientists gather data on how emotional responses and body language can foster meaningful relationships in an inevitably droid-filled society. Increasingly, robots are integrating into our lives as laborers, therapeutic and medical tools, assistants and more.

While some predict mass unemployment or all-out war between humans and artificial intelligence, others foresee a less bleak future.

The Machine-Man Coexistence

Professor Manuela Veloso, head of the machine learning department at Carnegie Mellon University, is already testing out the idea on the CMU campus, building roving, segway-shaped robots called “cobots” to autonomously escort guests from building to building and ask for human help when they fall short. It’s a new way to think about artificial intelligence, and one that could have profound consequences in the next five years.

There will be a co-existence between humans and artificial intelligence systems that will be hopefully of service to humanity. These AI systems will involve software systems that handle the digital world, and also systems that move around in physical space, like drones, and robots, and autonomous cars, and also systems that process the physical space, like the Internet of Things.

You will have more intelligent systems in the physical world, too — not just on your cell phone or computer, but physically present around us, processing and sensing information about the physical world and helping us with decisions that include knowing a lot about features of the physical world. As time goes by, we’ll also see these AI systems having an impact on broader problems in society: managing traffic in a big city, for instance; making complex predictions about the climate; supporting humans in the big decisions they have to make.

Digital – The Ultimate Catalyst to Accelerate AI

A lot of [AI] research in the early days was actually acquiring [that] knowledge. We would have to ask humans. We would have to go to books and manually enter that information into the computer.

in the last few years, more and more of this information is digital. It seems that the world reveals itself on the internet. So AI systems are now about the data that’s available and the ability to process that data and make sense of it, and we’re still figuring out the best ways to do that. On the other hand, we are very optimistic because we know that the data is there.

The question now becomes, how do we learn from it? How do you use it? How do you represent it? How do you study the distributions — the statistics of the data? How do you put all these pieces together? That’s how you get deep learning and deep reinforcement learning and systems that do automatic translation and robots that play soccer. All these things are possible because we can process all this data so much more effectively and we don’t have to take the enormous step of acquiring that knowledge and representing it. It’s there.

Rules of Coexistence

As of late, discussions have run rampant about the impact of intelligent systems on the nature of work, jobs and the economy. Whether it is self-driving cars, automated warehouses, intelligent advisory systems, or interactive systems supported by deep learning, these technologies are rumored to first take our jobs and eventually run the world.

There are many points of view with regard to this issue, all aimed at defining our role in a world of highly intelligent machines but also aggressively denying the truth of the world to come. Below are the critical arguments of how we’ll coexist with machines in the future:

Machines Take Our Jobs, New Jobs Are Created

Some arguments are driven by the historical observation that every new piece of technology has both destroyed and created jobs. The cotton gin automated the cleaning of cotton. This meant that people no longer had to do the work because a machine enabled the massive growth of cotton production, which shifted the work to cotton picking. For nearly every piece of technology, from the steam engine to the word processor, the argument is that as some jobs were destroyed, others were created.

Machines Only Take Some Of Our Jobs

A variant of the first argument is that even if new jobs are not created, people will shift their focus to those aspects of work that intelligent systems are not equipped to handle. This includes areas requiring the creativity, insight and personal communication that are hallmarks of human abilities, and ones that machines simply do not possess. The driving logic is that there are certain human skills that a machine will never be able to master.

A similar, but more nuanced argument portrays a vision of man-machine partnerships in which the analytical power of a machine augments the more intuitive and emotional skills of the human. Or, depending on how much you value one over the other, human intuition will augment a machine’s cold calculations.

Machines Take Our Jobs, We Design New Machines

Finally, there is the view that as intelligent machines do more and more of the work, we will need more and more people to develop the next generation of those machines. Supported by historical parallels (i.e. cars created the need for mechanics and automobile designers), the argument is that we will always need someone working on the next generation of technology. This is a particularly presumptuous position as it is essentially technologists arguing that while machines will do many things, they will never be able to do what technologists do.

But Could Coexistence Exist Eternally?

These are all reasonable arguments above, and each one has its merits. But they are all based on the same assumption: Machines will never be able to do everything that people can do, because there will always be gaps in a machine’s ability to reason, be creative or intuitive. Machines will never have empathy or emotion, nor have the ability to make decisions or be consciously aware of themselves in a way that could drive introspection.

These assumptions have existed since the earliest days of A.I. They tend to go unquestioned simply because we prefer to live in a world in which machines cannot be our equals, and we maintain control over those aspects of cognition that, to this point at least, make us unique.

But the reality is that from consciousness to intuition to emotion, there is no reason to believe that any one of them will hold. It is quite conclusive that the only alternative to the belief that human thought can be modeled on a machine is to believe that our minds are the product of “magic.” Either we are part of the world of causation or we are not. If we are, A.I. is possible.

Related Posts

AIQRATIONS

2017 Digital Trends

Add Your Heading Text Here

Digital transformation reshapes every aspect of a business. As digital technology continues to evolve, I believe that successful digital transformation will require careful collaboration, thoughtful planning, and the inclusion of every department.

During recent years, we’ve seen shifts in how traditional leadership roles operate, as silos break down and the scopes of various roles widen and change. Digital transformation has morphed from a trend to a central component of modern business strategy. Following are the enlisted major trends that will capture the gist of what is to come in 2017.

DIGITAL PLATFORM VIEW OF BUSINESS

A platform provides the business with a foundation where resources can come together — sometimes quickly and temporarily, sometimes in a relatively fixed way — to create value. The value comes largely from connecting the resources, and the network effects between them. As digitalization moves from an innovative trend to a core competency, enterprises will understand and exploit platform effects throughout all aspects of their businesses.

- The deepening of digital means that lines are becoming increasingly blurred, and boundaries semi porous — both inside and outside the enterprise — as multiple networks of stakeholders bring value to each other by exploiting and exploring platform dynamics

- CIOs are clearly being given the opportunity to lead a digital transformation that exploits platform effects majorly in managing delivery, talent and executing leadership

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2016/12/18/sameer-dhanrajani-key-win-themes-to-master-in-digital-business/

THE ADVENT OF IMMERSIVE CONTENT: AUGMENTED REALITY AND VIRTUAL REALITY

The booming success of the Pokémon GO AR app is a wakeup call to any business that hasn’t evaluated the potential of AR and VR. These technologies were once limited to the gaming realm, but they’re now easier to implement than ever before. The mainstream shift toward AR and VR provides new ways to connect with customers and offer unique, memorable interactions.

- The AR and VR resurgence will open up the gates for workplace gamification in a big way into a core business strategy

- 2017 is also going to mark a turning point in the way audiences interact with and consume video content through the releases of the HTC Vive, Oculus Rift, PSVR etc.

- Significant improvements in immersive devices as well as software is anticipated

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2016/05/27/sameer-dhanrajani-retail-industry-redefined-through-data-sciences/

SMART MACHINES AND ARTIFICIAL INTELLIGENCE ARE TAKING OFF IN A BIG WAY

Our relationships to technology continue to evolve. Soon machines will be able to learn and adapt to their environments. While advanced learning machines may replace low-skill jobs, AIs will be able to work collaboratively with human professionals to solve intensely complex problems.

- Data complexity is the top challenge standing in the way of digital transformation

- AI tools will evolve to read, review and analyze vast quantities of disparate data, providing insight into how customers feel about a company’s products or services and why they feel the way they do

- using AI to expedite knowledge-based activities to improve efficiency and performance will spread from reducing costs through automation, to transforming customer experience

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2016/11/18/sameer-dhanrajani-banking-evolution-using-ai/

GROWING IMPORTANCE OF THE USER EXPERIENCE

The customer experience (including employees) is the ultimate goal of any digital transformation. Customers are more cautious than ever; they’ll turn away from brands that don’t align with their values and needs. A top-notch user experience is a fantastic way to keep customers involved and engaged with your brand.

- Every touch point matters, and those leading the transformation will strive to constantly ask how they are removing friction and enhancing the experience for every customer regardless of where they are in the journey

- Understanding digital consumers’ biases, behaviors and expectations at each point along the customer journey will be at the heart of every successful digital transformation

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2015/07/24/sameer-dhanrajani-how-to-bring-about-a-customer-experience-focused-digital-transformation/

https://sameerdhanrajani.wordpress.com/2016/12/18/sameer-dhanrajani-key-win-themes-to-master-in-digital-business/

BLOCKCHAIN’S DISRUPTIVE GROWTH

What Uber did for on-demand auto transformation, Blockchain will to do for financial transactions. And with $1.4 billion in venture-capital money in the past three years, 24 countries investing in Blockchain technology for government services, 90-plus central banks engaged in related discussions, and 10 percent of global GDP to be traded via Blockchain technology by 2025-2027, it is important that marketers understand the potential implications for their business.

- Blockchain technology will majorly be a part of the next great flattening and removal of middle-layer institutions

- The semi-public nature of some types of Blockchain paves the way for an enhanced level of security and privacy for sensitive data – a new kind of database where the information ‘header’ is public but the data inside is ‘private’

- Data analytics using Blockchain, distributed ledger transactions and smart contracts will become critical in future, creating new challenges and opportunities in the world of data science

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2016/06/21/sameer-dhanrajani-data-sciences-fintech-companies-for-competitive-disruption-advantage/

DIGITAL TRANSFORMATION DRIVEN BY THE INTERNET OF THINGS (IOT).

Speaking of how invaluable big data is to marketers, the IoT offers immeasurable insight into customer’s mind. Businesses and customers alike will continue to benefit from the IoT. With an estimated 50 billion IoT Sensors by 2020 and more than 200 billion “Things” on the Internet by 2030, it is no question that IoT will be not only transformative, but disruptive to business models.

- IoT will change how daily life operates by helping create more efficient cities and leaner enterprises

- The staple tech for autonomous systems would be the Internet of Things (IoT) which would be the infrastructure, as well as the customers, since they work, interact, negotiate and decide with zero human intervention

- Real-time streaming analytics will collection, integration, analysis, and visualization of IoT data in real-time without disrupting the working of existing sources, storage, and enterprise systems

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2015/09/25/sameer-dhanrajani-real-time-streaming-analytics/

API ECONOMY

We live in an API economy, a set of business models and channels based on secure access of functionality and exchange of data. APIs will continue to make it easier to integrate and connect people, places, systems, data, things and algorithms, create new user experiences, share data and information, authenticate people and things, enable transactions and algorithms, leverage third-party algorithms, and create new product/services and business models.

- An industry vision seeks using APIs to turn a business into a platform involving digital business models

- As the Internet of Things (IoT) gets smarter, things using an application programming interface (API) to communicate, transact and even negotiate with one another will become the norm

Detailed Analysis can be found here:

https://sameerdhanrajani.wordpress.com/2016/02/12/mr-algorithms-the-new-member-in-the-board-room-to-discuss-algorithm-economy/

http://www.gartner.com/smarterwithgartner/welcome-to-the-api-economy/