Using Analytics for Detection of Earthquakes and Intensity Forecasting

Add Your Heading Text Here

We know the quakes are coming. We just don’t know how to tell enough people early enough to avoid the catastrophe ahead. Around the world more than 13,000 people are killed each year by earthquakes, and almost 5 million have their lives affected by injury or loss of property. Add to that $12 billion a year in economic losses to the global economy (the average annual toll between 1980 and 2008). Understandably for some time scientists have been asking if earthquakes can be predicted more accurately.

Unfortunately, the conventional answer has often been “no”. For many years earthquake prediction relied almost entirely on monitoring the frequency of quakes or natural events in the surroundings and using this to establish when they were likely to reoccur. A case in point is the Haicheng earthquake that occurred in eastern China on February 4, 1975. Just prior to this earthquake, the temperatures were high and the pressure was abnormal. Many snakes and rodents also emerged from the ground as a warning sign. With this information, the State Seismological Bureau (SSB) was able to predict an earthquake that helped to save many lives. However, this prediction was issued on the day when the earthquake occurred, so it did cause heavy loss of property. Had this earthquake been predicted a few days earlier, it could have been possible to completely evacuate the affected cities, and this is exactly where big data fits in.

Nature is always giving cues about the occurrence of events, and it is simply up to us to tune in to these cues so that we can act accordingly. Since these cues are widespread, it is best to use big data to collectively bring in this data to a central location so that analysis and the resulting predictions are more accurate. Some common information that can be tracked by big data is the movement of animals and the atmospheric conditions preceding earthquakes.

Scientists today predict where major earthquakes are likely to occur, based on the movement of the plates in the Earth and the location of fault zones. They calculate quake probabilities by looking at the history of earthquakes in the region and detecting where pressure is building along fault lines. These can go wrong as a strain released along a section of the fault line can transfer strain to another section. This is also what happened in the recent quake, say French scientists, noting that the 1934 quake on the eastern segment had moved a part of the strain to the eastern section where the latest quake was triggered.

Academics often put forward arguments that accurate earthquake prediction is inherently impossible, as conditions for potential seismic disturbance exist along all tectonic fault lines, and a build-up of small-scale seismic activity can effectively trigger larger, more devastating quakes at any point. However all this is changing. Big Data analysis has opened up the game to a new breed of earthquake forecasters using satellite and atmospheric data combined with statistical analysis. And their striking results seem to be proving the naysayers wrong.

One of these innovators is Jersey-based Terra Seismic, which uses satellite data to predict major earthquakes anywhere in the world with 90% accuracy. It uses unparalleled satellite Big Data technology, in many cases they could forecast major (magnitude 6+) quakes from one to 30 days before they occur in all key seismic prone countries. It uses open source software written in Python and running on Apache web servers to process large volumes of satellite data, taken each day from regions where seismic activity is ongoing or seems imminent. Custom algorithms analyze the satellite images and sensor data to extrapolate risk, based on historical facts of which combinations of circumstances have previously led to dangerous quakes.

Of course plenty of other organizations have monitored these signs – but it is big data analytics which is now providing the leap in levels of accuracy. Monitored in isolation these particular metrics might be meaningless – due to the huge number of factors involved in determining where a quake will hit, and how severe it will be. But with the ability to monitor all potential quake areas, and correlate any data point on one quake, with any other – predictions can become far more precise, and far more accurate models of likely quake activity can be constructed, based on statistical likelihood.

So once again we see Big Data being put to use to make the impossible possible – and hopefully cut down on the human misery and waste of life caused by natural disasters across the globe.

Related Posts

AIQRATIONS

Investment Analytics for VC & PE Firms

Add Your Heading Text Here

In the venture capital world, it’s all about the “hits.” A hit is a startup that makes it big, returning many multiples of a venture fund’s initial investment. Hits are great for everyone—investors, entrepreneurs, job seekers—but the problem is they don’t happen very often. The odds of a big hit are about one in 10.

Boosting the odds for VCs

But what if venture capital could boost its odds to 50-50, or even two out of three? With $48 billion in VC investment in 2014, such an improvement would prevent huge amounts of money from being lost on startups that never had much of a chance of surviving the harsh competitive environment. The challenge is to identify those likely laggards well before the market rejects their idea and, perhaps more importantly, to see the big hits before anyone else. Venture capital has long relied on subjective, intuitive methods of assessing startups, but that’s changing as more firms are bringing data science and consistency into their decision-making.

The next is to try to do the science, build the tools, and do the research all around this one question: How can we better predict when innovations will survive or fail, both for startups and when corporations launch new products or do acquisitions? There’s no human subjectivity involved anywhere along the line. All the algorithms converge on a discrete yes or no. That yes or no depends on majorly two areas – those inside the startup, and those external to the startup. Only around 20% of the predictive value to come from details specific to the startup itself whereas 80% comes from things outside of the startup, such as the market, customers, competitors, technology trends, and timing.

In this scenario, managers are trying to predict the future before investing money in it. According to analysis of data from the Small Business Administration, and data on startups, between 20% and 30% of new businesses survive to their 10th birthday. Startups with VC-backing, aren’t doing much better than spin-offs from large corporations. Has the entrepreneurship economy gotten any better at predicting any business? Data suggest no, not in any statistically significant amount. But Investment Analytics is turning that around. When it comes to predicting survivorship of companies after a 10-year period, implementing investment analytics at present setup can point you to the right answer 67% of the time, and totally wrong on the remaining third. So, If investment analytics has vastly improved the odds of investing in new technologies and businesses, why isn’t the entire VC world knocking on its door? Because A lot of venture capitalists, like the scouts in Moneyball reacting to sabermetrics, are skeptical. Most of the people don’t see quants taking over VC, even in the distant future, but they do see the potential of using data to help venture capitalists make decisions.

Data analytics are undoubtedly creeping into venture capital—Google Ventures uses an algorithm to help with investment decisions, and a Silicon Valley firm called Correlation Ventures is built upon an algorithmic investing strategy. But the old-fashioned process of detailed research and human judgment still has a lot going for it. Just ask the people at Lux Research, an emerging-technology consulting firm in Boston. For the past 10 years, Lux’s science-trained analysts have been scouring the business landscape for new technology firms, interviewing employees of those firms, and slowly compiling their own database of companies that succeeded or failed. Lux rates each company it profiles according to nine key factors, which are available to the public on its website in a report called “Measuring and Quantifying Success in Innovation. The result of that rating is a company profile with a “Lux Take,” which ranges from “strong positive” to “strong caution.”

The company recently looked back at five years’ worth of profiles and found that 50% of the companies that earned a “positive” rating went on to be successful, an outcome which Lux defines as an IPO, acquisition, or transition to standalone profitability. Given the usual odds of new business survival, the Lux system seems to inject a significant amount certainty into the process of evaluating startups. The company’s high rate of accuracy is attributable to two things: capability and methodology.

People talk a lot about the importance of innovation to economic growth. In a recent survey of voters in swing states by the Economic Innovation Group, 75% of those surveyed agreed that America needs more entrepreneurs and investors in order to improve long-standing economic problems. The innovation economy has an information problem. The information that drives it isn’t good. How can countries become innovation economies in a more efficient way? Let’s get better at funding the startup companies that will grow and drive employment. For every dollar that goes in the wrong place, that’s a bad dollar.

Better Investment Strategy for PEs

Data, and specifically the analysis of data is becoming a critical component in enabling private equity firms to create and maintain value for their investors. I know some of you are thinking, “What does a data management geek know about private equity?” One thing to note about private equity firms is that there has been a greater focus on IT and a growing need for data analytics services recently, especially for deals that involve middle-market companies and/or are add-ons to existing platforms. Increasing acquisition valuations and the dearth of available debt financing are making it increasingly difficult for private equity firms to generate outsized returns for their investors. This is causing private equity firms to focus more on operational improvements within their portfolio companies as a means of driving growth and value creation. Given the strong correlation between operational improvement and higher returns for limited partners, private equity managers’ hands-on involvement is, and will continue to be, critical to the future success of the fund. For private equity managers, this means identifying key drivers of EBITDA, understanding customer behavior, developing competitor analyses, determining the best place to invest capital, managing budgets, and controlling costs—for each of their portfolio companies. And to do it effectively and efficiently, managers must leverage data.

Nobody said it was going to be easy and the fact is: it’s not. Unfortunately, most of the private equity managers are not in a position to dig deep into the recesses of their portfolio company systems and extract the data tables necessary to produce key operational metrics. Therefore, managers will have to rely on the current workforce at each of their portfolio companies or hire an outside party to do the ‘dive into the data’ for them. Many of them struggle with capturing, extracting, and ultimately analyzing operational data within their businesses. This is largely due to the fact that, historically, middle-market companies have rarely made technology a priority, leaving them with an unsophisticated IT platform. As a result, when dealing with legacy and perhaps “home-grown” solutions, there are a variety of challenges that arise when attempting to harmonize, integrate, and perform data analytics. Additionally, many middle-market companies are experiencing data volumes that are growing exponentially and are held in disparate systems throughout the organization. In short, private equity managers are faced with massive amounts of “dirty” data that must be converted into meaningful metrics. This leaves private equity firm managers asking themselves, “How much time and money do I need to commit to information technology and data analytics?” Answer: more than you have in the past. The key is to invest wisely and in a way that will get you the greatest returns in the shortest amount of time. There are an infinite number of technology solutions out there. From off-the-shelf, in-the-box solutions to massive enterprise resource planning (ERP) solutions, software companies have done their best to provide an answer to your “big data” problems. Although there are many great tools out there, there is no cookie-cutter solution when trying to capitalize on the presumed synergies of integration. Private equity managers must understand the specific business needs and work to develop strategic analytical solutions driven from the data that already exists in their organization. It is critical, especially in today’s competitive market, to “leverage your data” and apply these targeting solutions in a way that will provide the greatest returns for your investors.

Big data may indeed be able to help, but it’s more likely to be a piece of the puzzle, not the solution. For instance, academic studies have shown that serial entrepreneurs successful in the past are more likely to do well in new ventures. That implies there is some explanatory power in looking backwards for guidance on what’s ahead. “But the nature of entrepreneurship is always changing,” says Josh Lerner, the Jacob H. Schiff Professor of Investment Banking at Harvard Business School. Most regressions predicting entrepreneurial success in the literature have very low goodness of fit, which suggests the limits of a ‘Moneyball’ approach here. Predicting which startup is going to be successful is much harder than [predicting] which baseball player is. It is as if the baseball rules are being changed every year in unpredictable ways.”

Related Posts

AIQRATIONS

How Startups can Improve Visibility in the Market Using Analytics

Add Your Heading Text Here

One might be tempted to think we are living in a startup bubble, with investors being largely optimistic about startups and investing millions of dollars in them, with many startups crossing the billion dollar valuation on a regular basis. But managing a startup is tough, with almost unreal targets set in between funding rounds. The founders need to, at all times, be focused on the direction in which they need to head, and be sure of the selective performance indicators that they need to keep watch of. Creating data has become easy at current times. Though acquiring data from multiple sources has its potential benefits, but for a company at its seminal stage, dealing with multiple KPIs is a huge risk. Startups can easily get side-tracked by following the wrong KPI. In an ideal scenario, startups should keep only one performance indicator and keep scaling up in that direction before achieving a milestone and involving others in the development plan. With a large number of startups around, existence of a red ocean, and ample amount of data giving number of insights and scope for strategies, implementing analytics can be a sure shot way to keep startups focused on the optimal way to scale up, and in extension create organic buzz and visibility to scale further. Analytics has the capacity to point out which should be the root nerve of a startup and how to scale further in that direction. The seminal stages of creating a high visibility in the market and expansion of a startup involves a repeated cycle of – Building and improving of the Core Competency, and measuring the effect in KPIs and increase in adoption by customers. Let’s see where and how analytics can be optimally implemented for these scenarios.

Building Core Competency

The starting point for understanding core competences is understanding that businesses need to have something that customers uniquely value if they’re to make good profits. “Me too” businesses (with nothing unique to distinguish them from their competition) are doomed to compete on price: the only thing they can do to make themselves the customer’s top choice is drop price. And as other “me too” businesses do the same, profit margins become thinner and thinner.

This is why there’s such an emphasis on building and selling USPs (Unique Selling Points) in business. If you’re able to offer something uniquely good, customers will want to choose your products and will be willing to pay more for them. Here are three ways to turn analytics insights into actions that make your company more competitive:

Gain control along with visibility of patterns

People often use analytics to understand what’s already happened, but don’t look beyond “what”, to ask “why.” By understanding why certain patterns emerge in your data, you gain greater visibility and control over what’s happening right now.

For example, when you understand why certain factors affect your margins, your sales team is better able to address underperforming products and customers, identify potential revenue opportunities and design more optimal coverage models for your reps.

Put analytics in the right functional areas to drive change

To get results, you need a way to deliver analytical information to sales reps at the product and account level. This empowers reps to negotiate from an informed position and use data to have strategic conversations with customers.

Also, when reps have good access to customer analytics, they’re better able to invest coverage resources in high-quality leads. It helps them to identify opportunities with large value and position sales offers in the context of a dynamic market. For example, if there’s a lot of variability in a commodity and price wars break out, you want to quickly reposition your offer in relation to that dynamic market.

Build an ecosystem

To get the best results from your analytics, you need the ability to monitor what’s happening and use that data to adapt. As you build this process into your company’s DNA, constantly evaluate the criteria you’re using to ensure they stay relevant: Are you looking at the right variables and assessing the marketplace effectively? By maintaining the quality of this information, you’re developing a competitive advantage through pricing and sales sophistication.

Measuring Business Traction

Traction Analytics

Analytics helps your business determine what is working well, and what needs to be improved. We can always go off of a hunch, but the real power comes when we know the hard data behind our marketing or business management efforts, and can make informed decisions that improve our business over and over. Seasoned entrepreneurs know just how important analytics are in growing your business. Without a serious analytics strategy, you are simply relying on hope and luck to grow your company.

In a startup you are constantly under pressure and have way too many distractions. Having a set of metrics that you watch & that you feel are the key drivers of your success helps keep clarity. And the more public you can make your goals for these key metrics the better. Make them widely available inside the company and share your most important goals with your board. Transparency of goals drives performance because it creates both a commitment and a sense of urgency.

If you don’t have a stability goal stated for the company and if you don’t regularly measure how you’re doing against this goal you won’t have your resources focused on the right priorities in the company.

Most companies have some measurements, but I would argue that people often measure the wrong stuff, measure with the wrong precision. The best way is to start by asking yourself at management team level: what are our company objectives and how do we best measure them? Because it can be hard to define or agree company objectives at an early stage I believe most people avoid them.

Customer Acquisition

At the highest level you’ll obviously want to track how many customers you’re adding every month (and for some businesses that have hit scale this is measured on a daily basis). If you can break this down by channel that you’ve acquired them from this is obviously better.

How many additions came through organic SEO? How many through affiliate deals? How many through SEM? Do you have a customer referral program? If so, make sure you can track which leads come from this. Measuring viral adoption is obviously important.

Usually you have a catch-all bucket for “direct” or similar that often came through PR or word-of-mouth.

If you have multiple versions of your product, how many are web vs. mobile? How do the mobile customers break down by device type?

The next step after measuring the customers you’re adding is to add the “cost to acquire” by channel. This is important because it will later tell you whether you have a scalable business or not. In the early phases if you can’t acquire customers cost effectively enough you’ll need to diagnose why and how to fix it.

The Final Question of Scalability

The repeated cycles of Building and re-engineering and Core Competency and Measuring the Market environment effects takes the startups further and further into the final stages of having a scalable model. Like I mentioned at the beginning, there could be n number of directions a startup can head towards, as many as there are number of significant KPIs that need to be improved. But finding the right nerve and chasing the wrong performance indicator is the difference between ending up with a scalable business model and ending up with a marginally incremental model. In this current age of every changing topography of the market with disruptive ideas entering and washing off many hopeful businesses, only having an optimal analytics solution to track their locus can make sure startups sustain and succeed.

Related Posts

AIQRATIONS

Building a Robust Data Strategy Roadmap – Part III

Add Your Heading Text Here

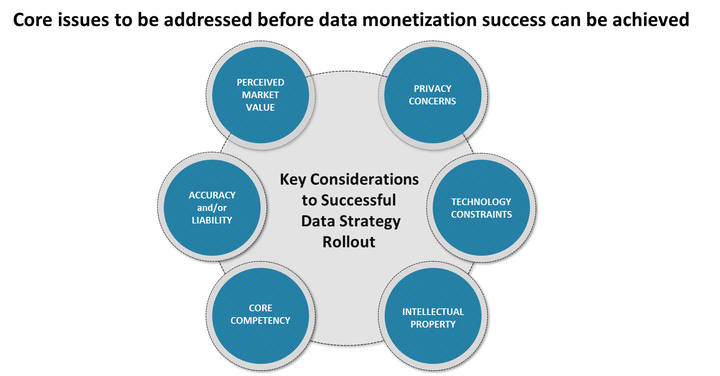

In continuation to my last article on Building a Robust Data Strategy, let me meaningfully conclude it by highlighting some of the core issues which need to be addressed before data monetization could really be called our as a success and ROI is achieved.

Privacy Concerns

Company needs to have the implicit and/or explicit statutory or legal right, or the ethical right, to divulge private consumer data – either personalized or depersonalized, individualized or at an aggregated level. Especially in industries where regulatory bodies have a heavy clout over what data is being used to cull out actionable insights or even the data flow within or beyond the walls of the organizations. Numerous articles, reports & surveys have highlighted how crucial is for businesses to operate within the ethical boundaries of data gathering or dissemination. Leave no stone unturned to see what policies/restrictions/guidelines are in place for the industry you operate in, how easy/difficult is to access data, and what are customer or end user reactions. You definitely do not intend to burn bridges with your existing customer base or repel away new prospects. Legal actions can be fatal to business at times. Be doubly sure what you are up for!

Technology Constraints

Do have a thorough understanding of the technological or hardware-related considerations to implement the strategy chosen to monetize the data. At times, organizations don’t have the requisite resources to execute on their strategy, may be because that’s not their core area of operation or it’s happening in silo’es across the organization which the business unit in question is not privy to. A complete landscaping exercise to understand the current state of business, what’s new in the market & what the competition is up to, what’s the future state & a step-by-step roadmap to mature technological prowess. In many cases, businesses hire external consultants or seek handholding by analytics service providers who have the requisite experience in recommending about the gaps & even executing on filling those. A thorough detailed analysis (but not analysis-paralysis) is crucial to the overall success.

Intellectual Property

At times, organizations sitting on huge pile of valuable data choose to make it available in the market (as another viable revenue model to monetize data). How much data to sell and how to determine costs vs. benefits in putting valuable data on the open market should be thought through. Be privy to the pros & cons of each approach & choose your business model accordingly.

Core Competency

Depending on its core competency, organization needs to identify at which level it wants to monetize the data in the data value chain. Data at each & every touchpoint in the value chain may have its own peculiar problems (missing data, incorrect data etc) and not all of it may be relevant. If your differentiator is “speedy delivery” of goods to your customers, focus on picking the right data sets across the value chain which helps streamlining operations, optimize inventory & transit time. Know what you are best at or what you are known for in the market and harness data capabilities to strengthen your business on that front.

Data Accuracy and/or Liability

Potential problems with inaccurate or directly or indirectly regulated data insights or products hitting the market place. Make sure that data assimilation, aggregation & cleansing exercise is robust enough to ensure the analysis/insights being generated out of it have a high probability of giving the right sense of direction to the business. At times, over-ambitious expectations or poor data quality can directly impact the quality of the outcomes. Garbage-in Garbage-out is the mantra & business managers should perfectly understand the gaps in the data & be cautious before making any solid commitments.

Perceived Market Value

For larger market opportunities, it is likely that an organization would want to play at the higher level in the data value chain. Umpteen times that completely derails the whole Analytics ROI & data monetization exercise. Focus should be specifically on business model(s) used to monetize the data than otherwise.

All the aforementioned considerations should set a good pretext to the data monetization exercise and may be the key to unlocking true value from data strategy initiative. In my subsequent edition, I shall bring to light the “Analytics Centre of Excellence” concept & how can organizations setup a full-fledged Analytics unit to deliver insights to departmants/LOB’s/functions across the business and also serve as a backbone to building a data-driven organization of the future. Stay tuned !

Related Posts

AIQRATIONS

Building a Robust Data Strategy Roadmap – Part II

Add Your Heading Text Here

Unarguably, data and technology is truly redefining & rehashing the way companies do business. Organizations have always had data, which they have utilized to run their businesses more efficiently but recent developments have transformed the way data is utilized by such organizations.

In today’s disruptive economic environment, all leaders are vying for identifying new revenue streams and identifying existing value streams inside the organization especially data. This is where the concept of crafting a Robust Data Strategy comes in, how do we make most of the Dark Data ? Data is now being looked as an asset and business models are now being build around this vast value pool which is hidden inside the data being stored. Enterprises are now anticipating future needs based on preference insights culled out from past & present data. They are creating new products and services in tune with what their customers exactly seek. They are lending an ear to all suggestions/recommendations/feedback shared and also responding to queries/concerns in real time. They are doing it all with data and analytics.

While many companies are becoming aware of the opportunities embedded in their enterprise data, only a few have developed active strategies to monetize it successfully. Data Strategy requires companies to not only understand their data, but also to uncover gaps and evaluate suitable business model(s) for appropriately monetizing the enterprise data. To evaluate their respective monetization opportunities in a more informed and results-driven manner, companies need to assess the value of enterprise data, determine how best to maximize its potential and figure out how to get the data to the market efficiently.

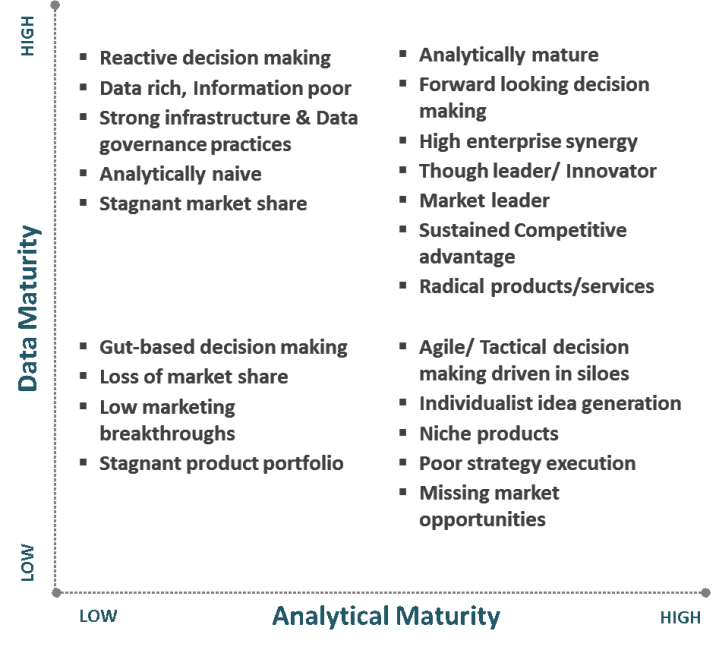

Four Stages to Analytics Sophistication

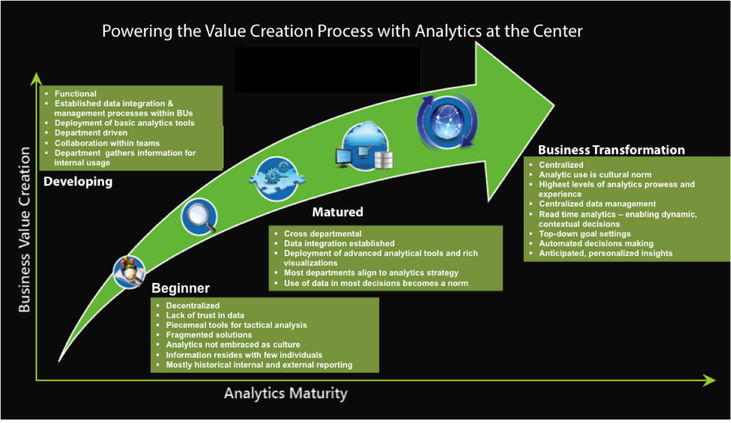

Based on the current state of data affairs, any organization can be categorized as a beginner, developing, matured or leader. In the initial stages of transformation, organization typically

lacks synergies due to silo’ed efforts, is less agile and more prone to errors, with perennial data quality concerns. As they mature to be leaders in the Analytics space, data sits at the heart of business, with increasingly automated, instant, accurate and seamless data driven decision-making.

- Beginner: Basic infrastructure and tools, proliferation of dashboards and reports

- Developing: Building tools and processes for historical as well as deep diving analysis to gain some insights for future actions

- Matured: Organization adoption of advanced analytical capabilities to predict future outcomes

- Business Transformation or Leader: Centralized analytics focus with capabilities to anticipate future and act in a data driven manner

Time’s ripe to ride on the Data & Analytics wave

Enterprises capture a lot of data, most of which is often overlooked. With reducing costs of capturing and storing data, increasing data analysis capabilities and superior analytical technologies available, enterprises have started to recognize data as one of their most valuable assets. In the few years, enterprises who lead the way in reorienting their approach, initiating enterprise wide data-led transformations and effectively monetizing their data are expected to be in the forefront. Typical market forces driving widespread adoption of Analytics are:

Technological Advancement

- Technology advancement has facilitated real time data analysis and personalized communication

- Big data technologies, cloud computing, machine intelligence and other advancements etc. have made analysis simpler & efficient

Rise of Consumerism

- Influx of more demanding consumers will force a wave of change

- Consumer engagement and experience management are key levers to success

Data Explosion

- Daily volume of data being captured increasing rapidly

- Cost of storing data decreasing massively

- Recognition of amount of under-utilized data that can be used to derive additional value

Increasing importance of Analytics & BI

- Business Intelligence and Analytics becoming an integral part of organization’s decision making

Economic Pressures

- Pressure on profit margins are forcing increased focus on efficiency and cost reduction

- Increasing competitive pressure

Is your Data truly worth it?

How much business value can be created via data on which organizations are sitting on depends primarily on the following factors & to an extent determines the success of any Analytics initiative.

Predict Behaviour (Patterns)

Enterprise data should be detailed enough to build a successful data monetization strategy. E.g. Customer data should be detailed enough to be able to predict customer behavior, patterns etc.

Size of the Ecosystem

Businesses with high volume, large breadth of data have the ability to generate highest value from the data. Companies with national or global scale can easily establish market view, which makes it more meaningful and valuable

Accessibility and Actionable

Data becomes valuable only if its rich, actionable and accessible. Structured, & readily scalable data makes the process of monetization simpler and efficient, providing higher potential for data monetization

Customer Identification (Granularity)

Data becomes valuable only if it is granular enough to be able to identify the end user/ customer. Ability to identify/ profile customers helps in expanding the range of products and servives that can be offered

Uniqueness

Uniqueness of the enterprise data is extremely valuable. It makes the products/services offered by the enterprise exclusive to the enterprise, sustainable differentiation which most organization yearn for

Stages to Data Maturity

Based on maturity of organization’s data, it can take a call what kind of a player it wants to be in the market – a “data seller” or a “full services provider”.

Raw Data

- Selling raw unprocessed data to outside stakeholders

- Companies with rich pool of high quality raw data can onsell such data with little investment required

E.g. – Pharma related data or even NASDAQ’s “Data on Demand” service to its ecosystem of partners in the capital markets

Processed Data

- Companies collect and integrate data from multiple sources

- Data is processed, stored and leveraged in summary form

- Secure capture and transport of data

- Proper storage and management of data using a data platform

E.g. Card Advisory companies provide processed data to merchants and/ or use it for improving its operational efficiency

Business Intelligence/ Predictive Insights

- Tools and technologies such as data mining, predictive modeling and analytics convert data into insights

- Insights are made available to the stakeholders (both internal and external) to drive business decisions

E.g. Wal-Mart segments its customers into three primary groups based on purchasing patterns to spur growth

Products & Solutions Implementation

- Data-driven interactions with end users

- APIs and ability for companies to access platform and data to build comprehensive products and solutions

- Companies use the intelligence to improve product and solutions offering portfolio

E.g. Tesco bank uses Clubcard customer data to identify customer needs and creates new personalized offers

Key Elements to Designing a Robust Data Strategy

Unravel Customer Needs

- Continually understand the customer needs to unearth customer requirements and preferences

- Understanding the delivery and integration models that clients require in order to benefit from enhancements

- Create a business model which fits into the core competency and create offerings which fir into client platforms and applications

- Invest in continuous learning and management of customers’ unmet needs ranging from enhancements to new products/ solutions

Decrypting the Enterprise Data

- Understand the enterprise data captured across all business lines and develop an enterprise wide nomenclature for the same

- Identify and map data and analytics services across business units to understand what types of capabilities can be leveraged to build new products and services using the appropriate business model

Gauging the Market Potential

- Calculate the market potential for the various opportunities identified

- Estimate the revenue potential, internal rate of return, investment required, cost reduction, efficiency etc. for the process

- Understand the key competition, factor in macro and micro factor which can affect the marketplace demand

- Seek out opportunities to enhance the core business or develop new products and services.

Deciphering the Value Chain

- Develop insights into partners and competitors across the value chain including upstream suppliers, data partners etc.

- Identify the new opportunities that can be available across the value chain

- Create a comprehensive view of the data ecosystem

Enhance the existing infrastructure

- Develop a sophisticated yet flexible architecture, suitable technology and applications which can help unlock the value that the opportunities might presents

- Put in place a data infrastructure that can provide the necessary foundation to enable the organization to unlock the value of data assets

The crux of the matter is that with the huge amount of data available with the enterprise’s in today’s competitive and converging business environment, they should start looking for market opportunities leveraging the data available with them. Most of the enterprises still do not consider data as an asset which they can monetize if they choose the correct business strategy and build the required capabilities. Enterprises can not only make better use of their internal data to enhance the current product and services portfolio, it can also provide new insights into the value chain and could transform the enterprise, unleashing a whole new set of products and services for the customers.

By utilizing internal data with external data, powerful generation of high margin solutions can be developed which can transform an entire organization which possesses enormous revenue potential. Done properly, data ecosystems can fund the transformation, create value for customers, and build long lasting relationships with other partners firms, 3rd party vendors & suppliers. But to ensure the true value of data is being monetized by the enterprise, it is essential that it follows a streamlined process to identify the most suitable business model(s) taking into account all constraints which the process might need addressing.

Related Posts

AIQRATIONS

Journey to Analytics Transformation is a Marathon, not a Sprint

Add Your Heading Text Here

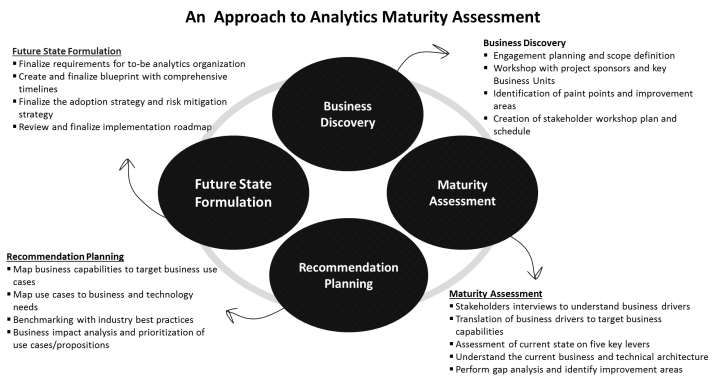

The environment today in which organizations across the globe operate in continues to grow more complex with every passing second. With innumerable choices to make, relentless pressure to deliver consistently in a time bound manner and rationalizing profit margins, the decision-making process becomes yet more daunting and convoluted. Unarguably, Analytics consistently delivers significant value – from strategic to tactical, managing top-line to bottom-line – to the organizations and business executives who use it. But senior leaders are still grappling with the question whether they are truly harnessing the fullest value from the massive amounts of data at their disposal; “dark data” sitting within their organizations in silos. Advent of newer technologies are making data collection faster than ever before, and it may seem like an overwhelming task to turn data into insights and answers that drive the strategic imperative. Storage & computational capacities have grown by leaps and bounds, opening up doors to intelligent decision-making for varied business stakeholders, yet many organizations are still looking for better ways to obtain value from their data and compete more effectively in the marketplace. The fundamental question about how best to achieve value still boggles most of the leaders.

Is competition equipped to obtain more incisive, timely and valuable insights? Are they catching the pulse of the global economy, the marketplace, the customers & the industry much better than what we do? Do they have better foresight to unravel what happened and why it happened in the past, and are they in a much better shape to decipher their current and future state to take actions closely aligned to market realities for optimal results? What do these analytically mature organizations do differently and what sets them apart from the crowd? Have we gotten our approach and data strategy right? Have we empowered our workforce enough to effectively leverage our Analytics insights? Has it seeped in appropriately to all the downstream decision makers? Plentiful questions abound and more often than not these perennial doubts do keep bothering the senior leadership, “are we doing it the right way”?

And not so astonishingly, most of the well thought through Analytics initiatives and robust Analytics transformation journeys go for a complete toss or fail to deliver value. From lack of senior leadership buy-in to Analytics value, advanced analytics applications not being put to best of their use, or a proliferation of analytics applications that fail to deliver a unified, solid strategic direction, many companies are falling short of the value analytics can provide. No wonder leaders end up losing patience and Analytics remains to be an elusive concept to most, putting up barriers to widespread Analytics adoption at the very beginning itself. Consequently, the shutters are pulled down much before the Analytics champions get a chance to showcase even marginal business impact. All the tall claims mutually agreed upon just end up being farfetched dreams !

When businesses venture into the Analytics space and think about transforming their organization into an Analytics think tank, it’s no easy ask. The way expectations are set initially, that analytics-driven insights to be consumed in a manner that triggers new actions across the organization, they must be closely linked to business strategy, easy for end-users to understand and embedded into organizational processes so that action can be taken at the right time. Now just mulling over what I just mentioned here, it’s a mammoth task in itself with too many ifs and buts. Just imagine the complexity we are dealing with. Let’s quickly take a high-level perspective of what kind of challenges do most organizations stumble upon, and understand the critical ingredients to a perfect Analytics recipe are:

- Right problem statement where analytics could have a strong play

- Right Data to begin with

- A strong team of Analytics professionals (Data Cleansers, Data Visualizers, Modelers etc) with a right blend of skill sets

- Senior leadership buy-in and requisite budgets

- Clearing other internal toll gates

- Program review framework to track progress & suggest realignment

- And the biggest of them all, a drastic shift in the mindsets of business users consuming these insights, how to make the transition process seamless

Aforementioned list is just a flavor of typical roadblocks your Analytics initiative could run up against and I haven’t even gotten into the finer details of spending wasteful time on Analytics tools/techniques which may not fit the bill. In a nutshell, the pitfalls are too many and as advocates of Analytics, it’s imperative for us to convey the same picture to the right set of business stakeholders in the organization that Analytics may take time to deliver value. And the wait could get even longer if a structured and methodical approach is not followed here. Undoubtedly, it requires painstaking focus on the way insights are infused into everything from manufacturing and new product development to credit approvals and call center interactions.

So what truly makes certain companies so successful with analytics initiatives while others fail to get the results they are looking for? Analytically mature organizations approach business operations very differently than their peers do. Disproportionately analytic leaders are having management support and mandate for analytics throughout the organization, including top-down diktat for analytics, sponsors and champions; they are open to breeding change and accept new ideas; having a focused approach to customer experience driven by analytics; and heavily use analytics to identify and address strategic threats to the organization. On a specific note, they deploy analytics across widest range of decisions, be it large or small. There’s a high correlation between organizational performance and analytics-driven management, and Analytics forms the key to all performance related aspects, be it seeking growth, efficiency or competitive differentiation.

The path to realizing value out your Analytics efforts and investments is a long-drawn process. But still, how can organizations bring down the time-to-value for analytics? How can you avoid common pitfalls which may derail the Analytics intent your organization set out with? Analytics value creation can be achieved during the initial budding phases on the path to analytics sophistication. Contrarian to common assumptions here, it doesn’t require the presence of perfect data or a full-scale organizational transformation and small pilots to convey value should suffice. After initial successes, snowballing effect shall come to rescue.

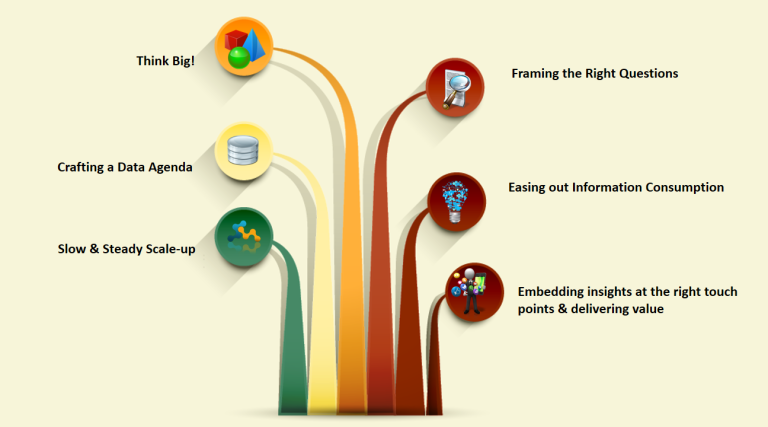

Think Big!

Does targeting the biggest challenge of all imply setting stage for big failures? Not always! Remember higher stakes command top management attention, appropriate investment, attracts best of the breed talent and incite action. Hence, focusing on the biggest and highest-value opportunities may not be that bad an idea. Don’t pick insurmountable problems though and ensure focus on achievable steps.

Framing the Right Questions

More often than not organizations are tempted to start the data assimilation process, way before they kick-start their analysis. A lot of valuable time & effort is spent in aggregating this data across various departmental silos, cleansing, harmonization, conversion etc. leaving little time for actually thinking through the intent of analyzing the data, and uncovering potential uses. To get optimal results, the idea should be start carving out the insights and questions which need to be answered to meet the bigger business objective rather than jumping on getting the data pieces together. Such an exercise at times can illuminate gaps in the existing data infrastructure and business-as-usual processes. Data-first strategy could mean lot of unintended rework, approaching a dead end towards the later stages and may be budget overruns in case additional resources are to be pooled in.

Easing out Information Consumption

In the end, the consumers of insights are the business users. In that case, the Analytics team may have to don the hat of a business stakeholder and be able to represent information in a meaningful way which sees direct applicability to their audience. Ability to convey the story in effective manner, figuring out better ways to communicate complex insights is crucial so that users can quickly absorb the meaning of the data and take appropriate actions. Leveraging numerous visualization and reporting tools can simplify insights, make results more comprehensible & easier to act upon. They can transform numbers into information and insights that can be readily put to use, versus having to rely on ambiguous interpretations or leaving them unused due to uncertainty about how to act.

Embedding insights at the right touch points & delivering value

With the proliferation of analytics applications and tools, embedding information into existing business processes, workflows etc is a lot more streamlined. For e.g. insights from your location analytics tools can easily be superimposed over existing maps-based applications deployed at the Salesforce level to help them plan out their routes optimally. Oil exploration companies can easily embed the production or pipeline information into their existing enterprise-level systems for informed decision-making around the next best drilling site. Such innovative ways have to be through to make consumption of complex Analytics insights a lot easier across the organization. Point to note here is that, putting together a new system for consuming Analytics insights could mean a drastic cultural shift for the business users, and high resistance to change in such cases could lead to failures. If somehow these insights could be seamlessly infused into existing apps/tools or processes would mean smoother transitioning & better outcomes due to increased adherence.

Slow & Steady Scale-up

As the business mature on the analytics front over time, data-driven decision making slowly starts spreading its wings across the organization. And as the Analytics experience and usage grows, the value analytics can deliver grows multi-folds, enabling business benefits to accrue much faster than originally imagined. Not all functions/LOB’s/departments are at an equipotential when it comes to Analytics maturity. Business functions like finance and supply chain are inherently data intensive and are often where analytics first makes its mark. Harping on the early successes, organizations can begin expanding analytics reach to other units. Crafting reusable assets which could be repurposed, with slight modifications by other units could speed up the transformation process.

Crafting a Data Agenda

Dealing with disparate sources of information, sitting in silos across the organization, in varying formats & structures, and churning out divergent insights can be a daunting task and also convey a highly convoluted, incomprehensible picture at times. The data agenda should provide a high-level roadmap that aligns business needs to growth in analytics sophistication as the organization matures along the way. It should be flexible enough to keep pace with the changing business priorities and must have clearly stated guidelines or frameworks to aid transforming data into a strategic asset; data which is integrated, consistent and dependable enough. Data quality & effective governance processes can be set up to ensure seamless assimilation and healthiness of data being put to greater use. Even though, you tread down the analytics path with the biggest organizational challenge, start putting the data pieces together which deliver insights & get you closer to the actual solution, but then how this data foundation crafted aligns with the overall data agenda is crucial. Comprehensiveness of the data agenda builds up the requisite momentum to deliver meaningful nuggets of information across disparate systems organization-wide. Eventually the data agenda is at the very core of any analytics initiative, ensuring the “right piece of information” reaches out to the “right stakeholders”, with the “right set of business priorities” at the “right time”.

To expedite the process to path to value, start by identifying big business issues which would garner the right management attention and resources for execution, carefully cherry-pick challenges for which you see Analytics as the key enabler, taking into account the foreseeable changes in the operating ecosystem as you go along. Riding on assets capabilities already inherent to the organization, the core strengths, is the key and creating reusable components can help scale up fast to increase reach. And the most important of all, keep embedding insights generated at every step into existing business processes to deliver continuous business impact and monitor change.

Related Posts

AIQRATIONS

Analytics is all About Talent, not Pedigree

Add Your Heading Text Here

Organizations across the globe today are grappling with a data deluge and with the increasing reliance on mining data to carve out actionable insights and drive strategic imperatives, the relevance of building the right ecosystem of Analytics professionals is becoming commonplace. Qualified analytics professionals are scarce, though in great demand and generally command higher salaries than the industry normal because of their specialized skills.

For most, analytics is still in the realms of software tools and creating highly visual dashboards/reports/charts etc. But there’s definitely more to it than what meets the eye. Analytics has lot more to than just jazzing up data; it can enable fact-based business decisions based on that data. It primarily means working closely with the business stakeholders to uncover gaps in the business and using the knowledge to work with data appropriately, to come up with useful insights and recommendations the organization can focus on, to increase top-line or rationalize costs at a high level.

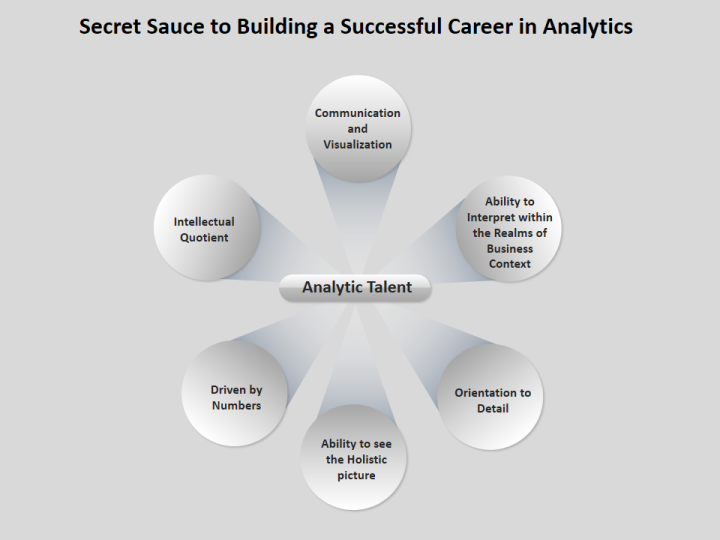

And many a times, the general perception about great talent directly correlates to the pedigree of an individual. Most organizations, especially in analytics space, are extra careful about their hiring channels when it comes to onboarding Analytics talent. And more often than not, we are generally biased to absorbing talent which has a strong pedigree credentials (academic excellence, b-school or t-school grade or tier et al) and fall prey to such generalized notions about building great teams. Unfortunately, Analytics is a different ball game altogether and successful career in Analytics has more to do with the underlying fundamental behavior of an individual. It’s an interplay of multidisciplinary skills ranging from mathematics, to statistics, computer science, communication and not to mention the business knowhow. Pedigree may be just a guiding beacon to highlight potential but definitely not a key ingredient to governing success. Let me shed some light on what it takes to build a successful career in analytics:

Intellectual Quotient

Successful people in the analytics industry today have that inquisitiveness and high curiosity attitude ingrained in their natural DNA. For any given situation they are presented with, they can think through and formulate the right set of questions, the “why’s” “what’s” & “how’s” which is key to succeeding in a professional setup. Even before jumping to the data analysis piece, it’s crucial to understand the business problem at hand, crafting out the specifics of the probable solution approaches and most importantly questioning the underlying assumptions being undertaken.

Especially ‘big data’ is more about the questions being put forward than the data itself. No data can speak for itself unless appropriately questioned. Success on dealing with ‘big data’ projects requires a thorough understanding of the problem, narrowing down the right questions, getting those answered by SME’s or business experts on right forums, making sure you harness the right amount of data to answer the questions at hand and then eventually communicating the solution to the target audience (which may be clients or the internal stakeholders).

Driven by Numbers

Being accustomed to using mathematical concepts and mathematical tools is commonplace in analytics space. Mathematics & statistics forms the basic foundation here and if for any reason this word strikes fear in your heart, think again! As you progress your career in Analytics and if you aspire to be truly a Data scientist, few additional skills shall be instrumental to your success: Machine learning, statistical modeling, experiment design, Bayesian inference, Supervised learning: decision trees, random forests, logistic regression Or Unsupervised learning: clustering, dimensionality reduction, Optimization: gradient descent and variants etc. The key aspect to note here is that most of these skills are picked up during the job or as special trainings and not directly linked to an individual’s pedigree. The number-crunching attitude forms the basis here and this is something inherent to an individual irrespective of which institute or academic background they hail from.

Ability to see the Holistic picture

Data here is just a means to an end and behind the scenes there’s a larger business problem at hand being dealt with. Unless there’s absolute clarity on what the client is actually intending to solve, you might end up looking at the wrong place or assimilate wrong pieces of information which may not be of any use. At times, the client isn’t quite sure about the problem they intend to seek answers to which may derail the whole exercise. Getting clarity on what’s the root cause driving actions is crucial.

There may be too many variables under consideration at the same time, but being able to see through clearly and importantly, being able to identify the next steps based on the larger intent is imperative. For instance, if the individual is assigned a problem pertaining to pricing analytics in an FMCG industry, it is very important for them to understand the dynamics between marketing, pricing, sales, promotions etc. work in this industry before. If it’s about evaluating the effectiveness of a marketing campaign for an FMCG product, domain knowledge shall help in narrowing down the key 10 or 100 variables that need thorough consideration from amongst the thousands available at disposition.

Again this ties back to our initial premise of inherent inquisitiveness of an individual to get the right set of questions framed and answered before any detailed analysis begins. Asking the “Why” questions at every juncture may help to uncover the latent objectives which client may not be articulate well in certain cases.

Orientation to Detail

Cognitive “attitude” and willingness to search for deeper knowledge about everything is a common strain running across all successful analytics professional. Though a bird’s eye view is good to have to better understand the larger business problem being tackled but at the same time balancing it against the specifics which need further drill-down is crucial. While dealing with voluminous stacks of structured or unstructured data, it’s easy to lose sight of specifics which be of immense value in crafting a solution to the original problem. Having that “hawk’s eye” to suddenly fish out significant patterns which may be of interest to business is a must have. Visualizing data through various plotting methods (box plots, histograms, correlation matrix et al) can help uncover those meaningful nuggets which the business is interested in.

Ability to Interpret within the Realms of Business Context

End of the day, it’s important to realize that numbers won’t speak for themselves unless the right set of tools/techniques/methodologies are employed to present the data in a consumable form. Numerous tools in the industry today have plethora of features to simplify data interpretation but the understanding of which visualization technique is most suited to give you the right picture, given the data in question and business problem at hand is the prowess of a well-acquainted analytics professional; one who knows his toolbox in & out. In some cases histograms may deem fit to understand the distribution of data and at the same time the box plot may get you a better idea of how the majority of data points are spread across the spectrum, or if there are any outliers. Domain expertise & business knowhow can help leapfrog your analysis to a different level altogether, help interpret the results in the business context, assess usefulness of results, bringing out insights which may not be that obvious to common folks.

Communication and Visualization

You may be a champion in your rarefied field, but you may not succeed as an analytics professional unless you can’t communicate the value of your analysis in simplistic terms, a language which the client or business user understands. Communicating the value to business people and asking the right set of questions on what’s important is table stake. Ability to convince that what you’ve done is viable and will deliver business value is something one should be excelling at.

Umpteen times there are disparate pieces of information which a good analytics professional should be able to connect and able to convey a compelling story which makes sense to the target audience. As an analogy, a leading insurer was observing overall dipping sales and post analysis it came to notice that customer service in certain pockets or geographies has dwindled because of inappropriate handling of customers over certain touchpoints. The analytics team was able mine the sales data for pain points, narrow down upon the areas with stagnant or negative sales growth and also uncover pattern between unsatisfactory customer comments over social channels (FB page, twitter handle etc). Survey results again hinted that certain geographies had observed lack of customer empathy as a major factor impeding lead conversion and high attrition. Sales data, social data and survey results in totality were able to narrow down upon those specific areas of concerns mapped to respective geographies, which now the business could pursue to chart out a customer experience roadmap for targeted geographies & remedial measures to mitigate potential bottlenecks identified.

To sum it all, a pedigree can convey so much so about an individual’s ability to succeed in building a thriving analytics career. It’s more about those innate capabilities, domain/analytics experience one garners on the job and regular trainings which forms the secret sauce to a differentiating career trajectory in analytics.

Related Posts

AIQRATIONS

Keeping Your Analytics Talent Motivated & Productive

Add Your Heading Text Here

Numerous studies in the past have shown that an engaged workforce significantly out-produces an unmotivated one. And even a greater number of those studies reinforce the common notion that employee creativity is the key to innovation and eventual customer or client satisfaction. To a great degree, for most industries and organizations, talent is one of the most treasured asset and to an extent a key differentiator in the marketplace. Every company needs creative team, decision makers and visionaries, but on a similar note, it’s equally important to have a motivated workforce who can give their all for the cause day-by-day. As clichéd it may sound, Analytics truly is one of the industries where the average churn or attrition rate has typically been on the higher side (as compared to industry average in general) due to great demand for Analytics experts in the industry across the globe and dearth of skills required. I presume all my readers would concur on the perennial challenge of analytics talent crunch most businesses are grappling with today. And even if you find the so-called right analytics resource that align with your skills requirements, you’re bound to chart out engaging career prospects and develop that talent over what could amount to a decade before that person is achieving optimum results for your company.

Analytics is all about working with an extremely talented & creative set of people, who need constant care and attention from their leaders & mentors. And undoubtedly, most businesses yearn to maximize output and increase topline, they need to have their team working as effectively as possible. But how should they go about this? A generally accepted phenomenon that happy workers tend to be productive ones – meaning there are clear benefits to keeping people engaged and motivated.

When it comes to job satisfaction, financial rewards may be lower on the list than most people think and as I reflected in my previous posts. Being happy with the job seems to depend more on the intangibles: feeling part of a team and being valued and appreciated consistently outrank money when employees are polled about job satisfaction. It’s all about keeping employees highly engaged & give them the due respect they deserve. Engaged analytics talent learns, grows, displays high leadership quotient, deliver heightened ROI and significantly decrease your organization’s turnover rate. However, keeping a team that approaches work with vigor and passion intact is easier discussed than executed.

Every other company which employs analytics services or is outsourcing it wants to hire and keep the best of the breed talent – how do you stay a step ahead? Clarity on company’s mission that they are driven to lead themselves is all commonplace and is a sanity in Analytics as with every other industry. And if an employee isn’t engaged creativity is not present! So what truly keeps this evolved species engaged enough?

- Where in the Organization your Analytics Talent sits

First & foremost, as leaders, we must acknowledge that Analytics talent is different from rest of the organizations and placing them rightly within the organization is crucial to ensure they are truly able to create the real impact. Bright minds cannot be chained or siloed or put in a bureaucratic hierarchy, lest they tend to lose their sheen and may end up attriting or be sitting ducks stuck up in the usual business stream where their skills are definitely not put to the best of use. Analytics talent should be led by analytic leaders who know this industry in & out; because they are the ones who understand how this talent needs to be groomed & nurtured, and shielded from the political bureaucracies and the analytics leaders should effectively communicate those differences throughout the organization constantly. Separate HR policies, working culture and operating rhythm is required to give these prodigies a conducive environment to deliver their best. They should acknowledge different processes for them, they should have different technical ladders, different job expectations. It must be thoroughly acknowledged that they have different motivations and is the organization in the capacity to carve out that special niche for thriving Analytics talent. Whether you keep them together in their own close knit group so they can keep their skills sharp with constant interaction with each other, or should they be spread across company’s business units because that is where they must have an impact?

It’s important for your analytics talent to garner complementary skill sets. Obviously, you intend to build a team with eclectic mix of skills instead of having all people who are good at data massaging or modelling or all people who do optimizations or visualizers. Analytics is a broad space and there are umpteen specialties, and piecing together these different puzzle elements is the key to generating impactful business insights. As an analytics leader because you understand the space, you understand these specialties. So to be a good leader of such a talented team, you really have to focus on the individuals on your team and help them succeed.

- A Robust Career Path

Talent always needs a clear future vision on their career trajectory & growth within the organizations with distinctive career paths through career ladders and lattices. A clarity/transparency on roles, career tracks and skill expectations has to be in place to affirm that your analytics professionals have a well thought through career roadmap charted out. Structured capability building, systematic learning and development frameworks could be crucial to ensuring that career architecture plan is laid out appropriately.

- A Rock-solid Training Regime

An effective training and development plan is one of the best ways to convey to your valued employees the commitment and faith you have by investing in them. And, when you consider this investment in the long run with a way higher ROI, the expense of a solid training program suddenly seems measly. With the pace the Analytics industry is maturing, it’s crucial that your talent is in tune with the current needs in the industry, has hands-on experience with the topical tools & technologies and is abreast with the latest and greatest techniques being used today to deliver business impact. Just to substantiate with an example here, R being open-source has tons of pre-built libraries & many more keep getting added to the repository, avoiding duplicity of effort and ensures optimal procedures/techniques are being employed which have proven to be effective & accredited by experts in the wider public analytics community. Smart talent is always hungry for more and it’s imperative for the analytics leaders to keep feeding their talent with all the trending skills/tools and keep their talent’s arsenal up-to-date.

- Empower them

Give your talent the wings of freedom, to innovate, to be creative, basically get out of their way and empower them, give them the requisite tools to deliver. Don’t keep them shielded from the real-world all the time & get them the exposure to be deeply embedded in the C-suite. The senior executives want to make decisions based on data and they trust this talent tremendously. Get them in front of the clients or the C-suite and give them the platform to talk to them directly as to what they are doing. That’s what keeping them there, as they feel that they are in the driver’s seat helping businesses navigate in a highly competitive, relentless environment. Highlight in appropriate forums about their achievements & the impact they have made.

- Business Exposure

Analytics professionals need to be spending a sizable time(between 6-10 years) to industry-specific challenges before they can have the right context to understand the problem well and know exactly know what’s needed & what not to go about finding a solution. This is among the scariest challenges which majority Analytics leaders across the globe are trying to figure out and still poses a big question mark for most on how to get their analytics talent a business bent of mind. Continuous exposure to the business, ongoing domain-specific trainings are hence an important ingredient to their success & keeping them relevant

- Challenging Work Environment

Throw all sorts of challenges and varied projects at your talent. Be it as far away from their comfort zones & let them drown in it. This is what they truly enjoy doing and they love finding their way out from the middle of nowhere. Organize week long hackathons, competitions & give them stringent timelines to deliver. Give them the opportunity to make the impossible possible. The sense of achievement & gratification after working their way out from challenges unimagined in their wildest dreams is what keeps them going. Let them mingle up with the wider Analytics talent beyond the walls of the organization; let them participate in global competitions organized by Kaggle, 5th Elephant, VCCircle, Analytics Vidya etc. Motivate them to join interesting discussions pertaining to Analytics online (twitter, blogs, linkedin communities) and make a contribution, be an expert advisor in the area they specialize in.

- Be the “Employer of Choice”

Value your talent, get them the requisite support and developmental environment from mentors & other experienced professional in your Analytics team, pay them well, recognize their contributions, and give them the opportunity to rise up the career ladder. Start collaborating with academic institutions from where you hire, increase interventions, do guest lectures, seminars, workshops, mentoring sessions, case competitions, “Shadow a Leader” program etc to be constantly engaged with your pipeline talent.

Related Posts

AIQRATIONS

Managing High Performance in Analytics Teams

Add Your Heading Text Here

With the recent massive explosion of data availability, significant leap in computing capabilities, substantial reduction in data storage costs and greater belief of businesses in analytical models has fueled the growth of businesses across the globe and demand of skilled professionals across all levels. However, businesses are demanding high level of performance from their Analytics Service Providers (ASP’s) and are increasingly insisting on translating spend into real tangible, quantifiable outcomes. In the given scheme of things, it is quintessential to measure and improve the performance level of analytics team while simultaneously juggling with the talent crunch of analytics professionals.

As per a recent study a recent survey of 300 IT professionals, conducted by a company called InfoChimps, a mind boggling fifty-five percent of big data analytics projects are abandoned.

And not so surprisingly, the biggest impediment topping the charts was the talent crunch. Almost 80% of the survey participants highlighted that the top two reasons why analytics projects fail are

- The inability of managers to connect the dots around data to come up with relevant actionable insights

- Lack of appropriate business and domain context encircling the data

The Common Analytics “Fingerprint”

Typical analytics skill set is predominantly different from the usual IT ones (more technical or programming-oriented. Primarily there are 3 key roles in analytics: Data Management (includes data assimilation, cleansing, harmonization etc.), Data Modeling or the Data Scientists roles (one who build models) and Data Visualization (the reporting piece). Following skills at an aggregate level are crucial to high-performance of any analytics team but in a nutshell CREATIVITY and CURIOSITY is the most crucial element cutting across all:

- Good with Numbers & Statistics

- Simple linear regression, basic statistics, hypothesis testing, Z- and T-test analysis can get you so much so that you can take those baby steps in Analytics. But to tame the real BIG beast at other times, you definitely need advanced statistics skills when the data becomes voluminous, unstructured or even when you are headed for predictive analysis

- Ability to triangulate numbers & doing back of the envelope calculations is imperative and is being commonly used to evaluate potential candidates looking for venturing into the world of Analytics

- Data management capability

- You shall be headed to nowhere unless your data isn’t clean and enough to perform further analysis,

- Ability to take calculated, educated risks; especially when it comes to taking assumptions, supported by valid arguments and a strong business sense

- Business/Domain Know-how

- Deeper understanding of the data and business problem at hand

- It’s equally important to contextualize outcomes for relevant insights which the business can pursue

- Visualization Capability

- Represent complex data in a simple and easy-to-understand way

- Ability to effectively present findings; intuitive to the decision maker especially when the consumer is a business user

- Psychological Skills

- Being pragmatic, overcoming cognitive dissonance, bias, over-confidence, conflicting thoughts or situations

- Maintaining extremely high sense of quality, standards, and detail orientation

- Storytelling Ability

- Ability to connect the dots, from data to insights in a compelling way, understandable by the business user

- Structured thinking process (especially when the job requires you to deal with unstructured data and complex business situations which may need a well-structured approach)

- Innovation Quotient

- Can the individual see beyond the ordinary! Cognitive “attitude” and willingness to search for deeper knowledge about everything

- Ability to productize ideas e.g. packaging a predictive model as a point solution (targeting specific business challenge with a specific approach to deliver tangible business outcome) OR creating reusable assets out of usual business deliverables which could be easily cross-pollinated and applied to other business problems or even industries

In addition, an analytics professional should have at least some of the following capabilities:

- Strong interpersonal skills, effective oral and written communication and ppt skills

- Agility, take a detour based on inferences being reflected in the data

- Passionate about stumbling upon interesting business problems and inclination to solve them

- Proactively seek clarifications and ask appropriate questions based on what’s shared

How to Evaluate High-performing Analytics Teams

Evaluation is primarily based on which track in Analytics an associate is aligned to (Business, Technology, Delivery, Domain/Industry, Modeling/Data Scientist). Due to the inherent nature of how the Analytics industry works or what clients expect out of us, it eventually boils down to quantifiable business impact, either it’s increased top-line or decreased bottom-line. Eventually it boils to Following are the key pillars of evaluation:

Analytics Pillar

- Data Management Capabilities

- Use of Data treatment techniques

- Quality of assumptions taken

- Quality of Analytics Deliverables

- Output Accuracy & Feasibility

- Visualization ability, intuitiveness

- Analytics SME Quotient

- Domain Knowledge

- Analytics Acumen

- Certifications, Trainings & other Up-skilling/Re-skilling initiatives undergone

- Going the extra mile !

- Identify, conceptualize & execute new solutions, Analytical concepts, techniques and / or prototype tools for a market or cross-pollinating ideas

- Going beyond the call of duty

- Mentorship, Internal trainings etc.

Business Pillar

- Business Knowhow

- Domain understanding and knowing how the industry operates

- Understanding of client’s ecosystem

- Quality of Insights/Recommendations

- Client-centricity, Business acumen

- Quantifiable top-line or bottom-line impact, value creation

- Tangible business outcomes & how it impacted client’s business

- Curiosity to work on most important business problems, ones which add value to the client

That data also shows the No. 1 reason analytics professionals leave their jobs is because they’re bored.

http://www.allanalytics.com/author.asp?section_id=1411&doc_id=266183

Soft Skills

- Effective Presentation & Business Communication

- Collaboration/Team Player

- Coaching & mentoring

- “Winning @ Workplace” attitude, Self-motivated

- Adaptability

- Decision-making skills

- Negotiation skills

- Leadership traits

- Cultural Fit

Related Posts

AIQRATIONS

Building a Robust Data Strategy Roadmap – Part I

Add Your Heading Text Here